Navigating Income Harvesting Strategies: Harvesting (0%) Capital Gains Vs Partial Roth Conversions

Author(s): Michael Kitces

Topics:

- Capital Gains

- |

- Roth Conversions

Year Published: 2020

My Rating: ⭐️⭐️⭐️

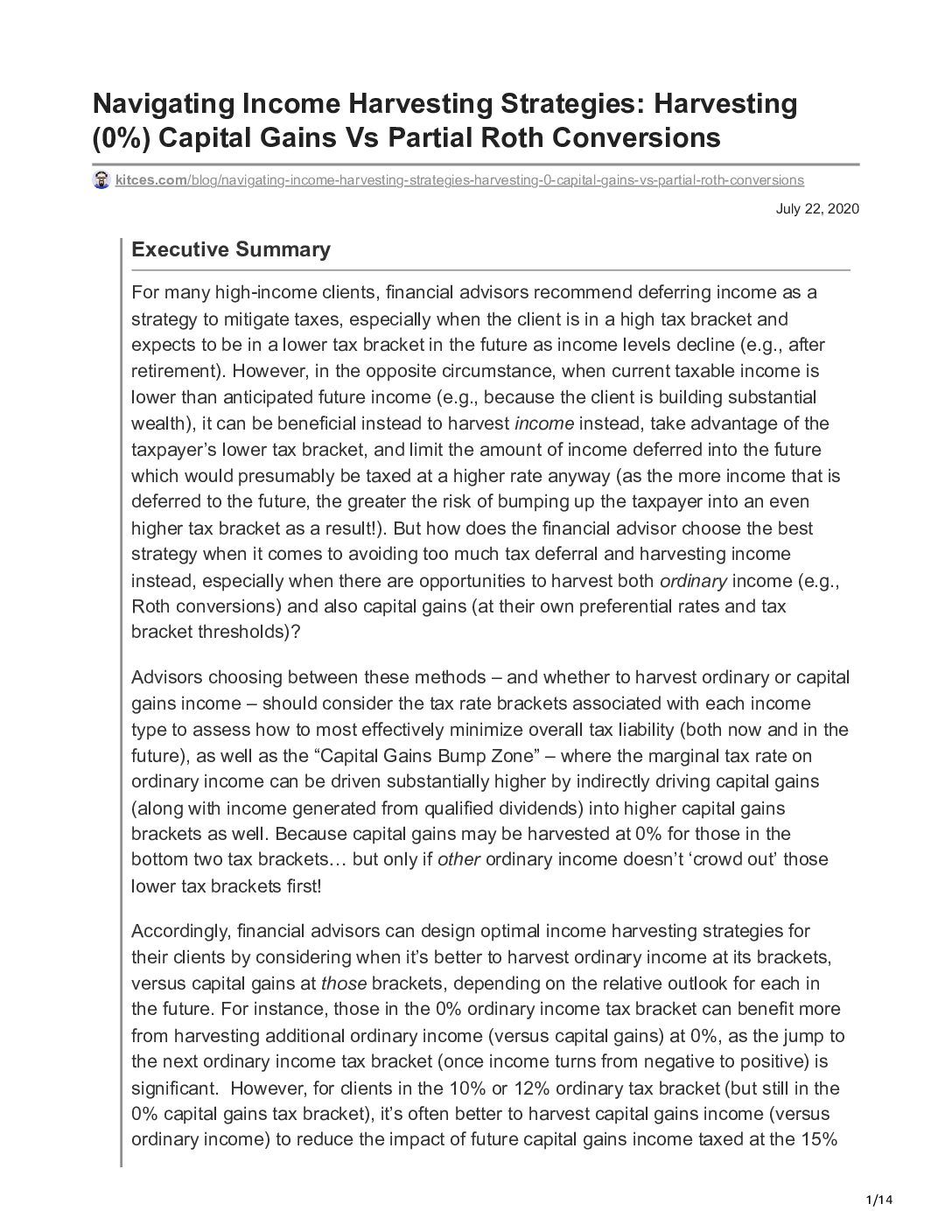

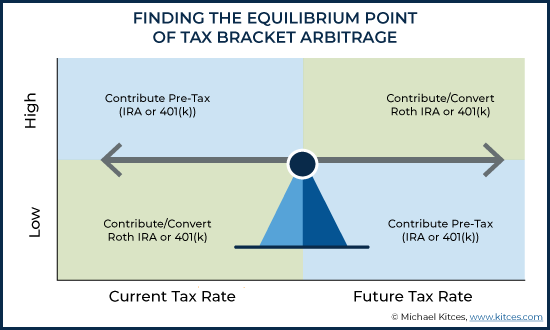

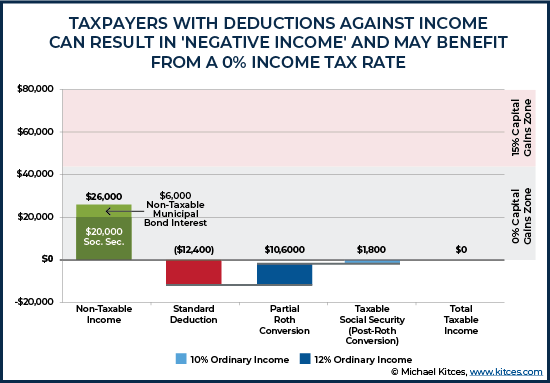

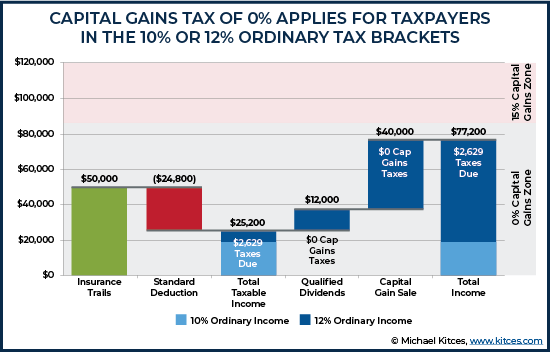

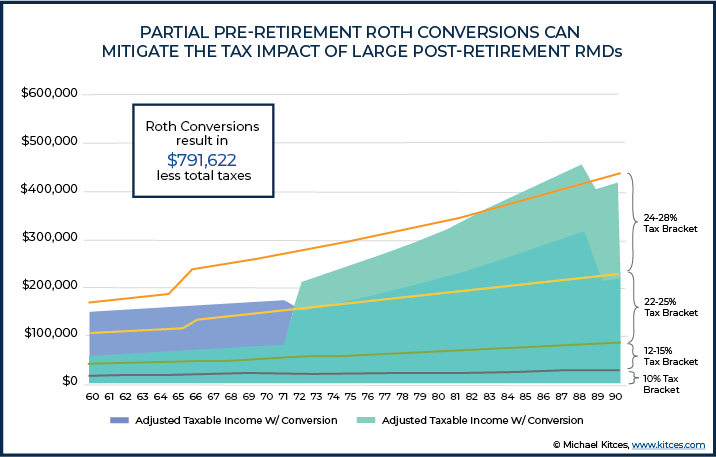

One Sentence Summary: The choice between Roth conversions and capital gains harvesting, both of which can take advantage of low tax brackets in the early years of retirement, will depend on the relative tax benefits of each, which change depending on one’s taxable income each year.

Summary

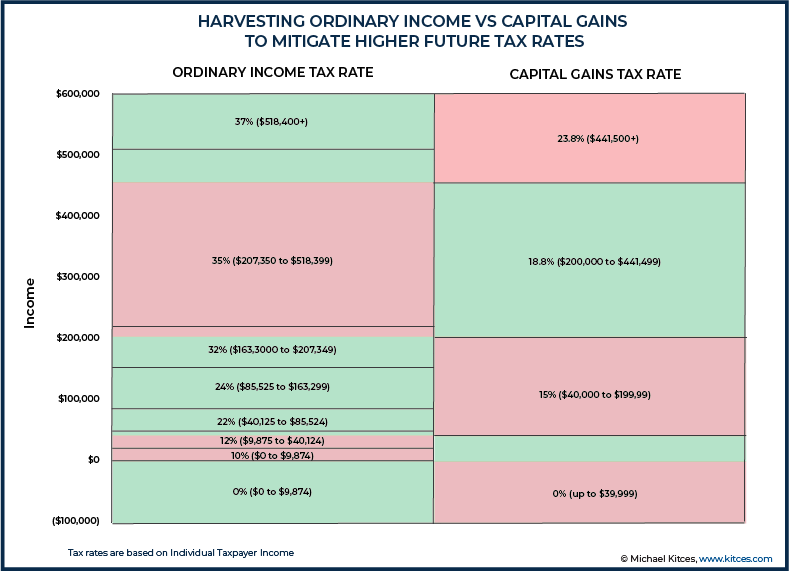

The article discusses the nuanced approach required to determine whether it is better to harvest ordinary income (e.g., via partial Roth conversions) or capital gains, based on an individual’s circumstances and potential mitigating factors. It highlights the importance of considering tax rates, tax bracket thresholds, and mitigating factors such as Social Security, Medicare premiums, and the Net Investment Income Tax when designing an optimal income harvesting strategy. The article also explores the concept of tax-gain harvesting, which involves strategically selling winning investments to reduce current and future taxes.