Kentucky Windage for Asset Allocation

Author(s): William W. Jennings, Brian C. Payne

Topics:

- After-Tax Allocation

Year Published: 2022

My Rating: TBD

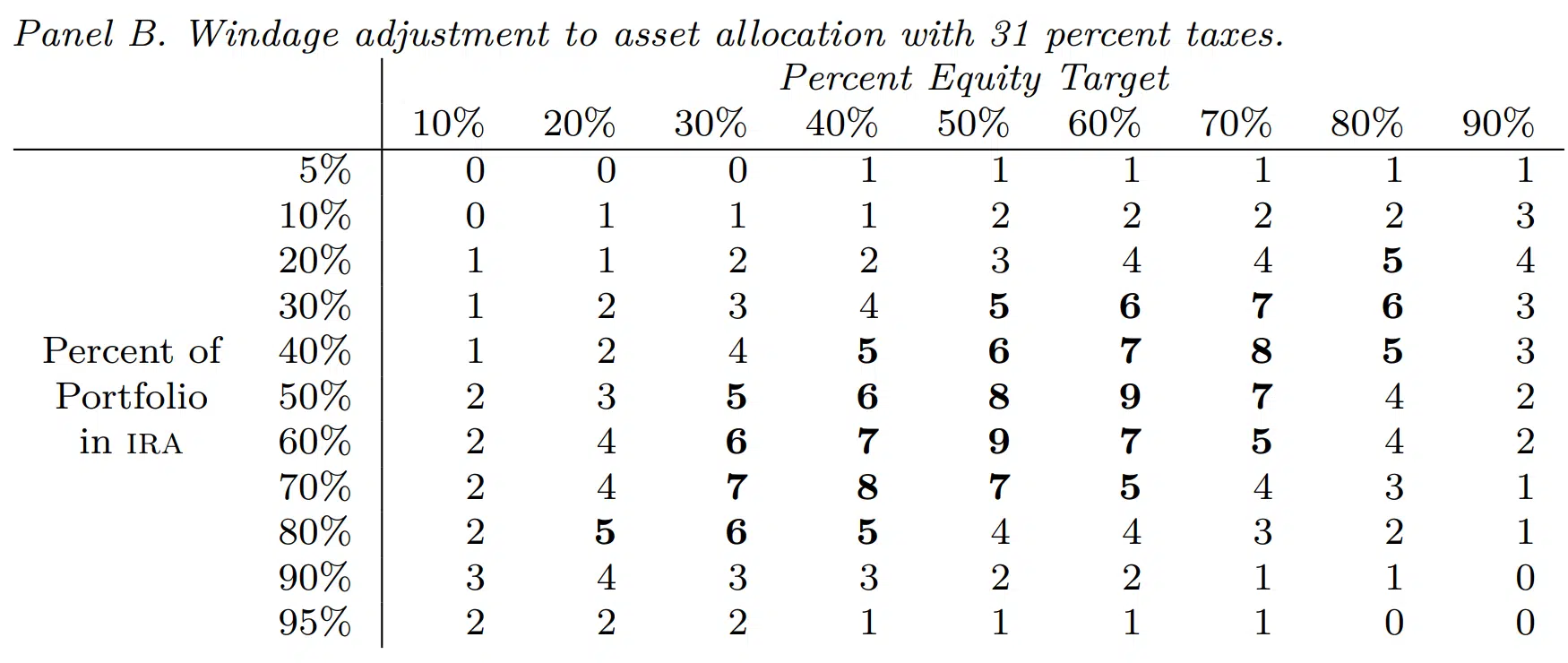

One Sentence Summary: The paper provides simple adjustments one can make to their asset allocation to adjust for the embedded tax liability of a pre-tax IRA.

Summary

Taxes reduce the value of investments in tax-advantaged accounts, creating a discrepancy between pre-tax and after-tax asset allocation. To correct for this, a “Kentucky windage” adjustment increases the pre-tax bond allocation by a percentage determined by tax rate, IRA size, and stock/bond mix. This ensures the after-tax asset allocation aligns with the intended target, mitigating the risk of holding a portfolio with a higher than expected stock allocation.