J.P. Morgan 2024 Guide to Retirement

Author(s): J.P. Morgan Asset Management

Topics:

- 4% Rule

- |

- Longevity

- |

- Retirement Accounts

- |

- Retirement Spending

Year Published: 2024

My Rating: ⭐️⭐️⭐️⭐️

One Sentence Summary: Offers data on retirement topics, such as longevity, savings requirements and Social Security claiming strategies.

Summary

J.P. Morgan’s annual guide to retirement offers a fascinating glimpse into the world of retirement. Here are some of the facts and figures I found noteworthy:

- In a non-smoking couple in excellent health age 65, there is a 73% chance that at least one of them will live to age 90 (slide 4).

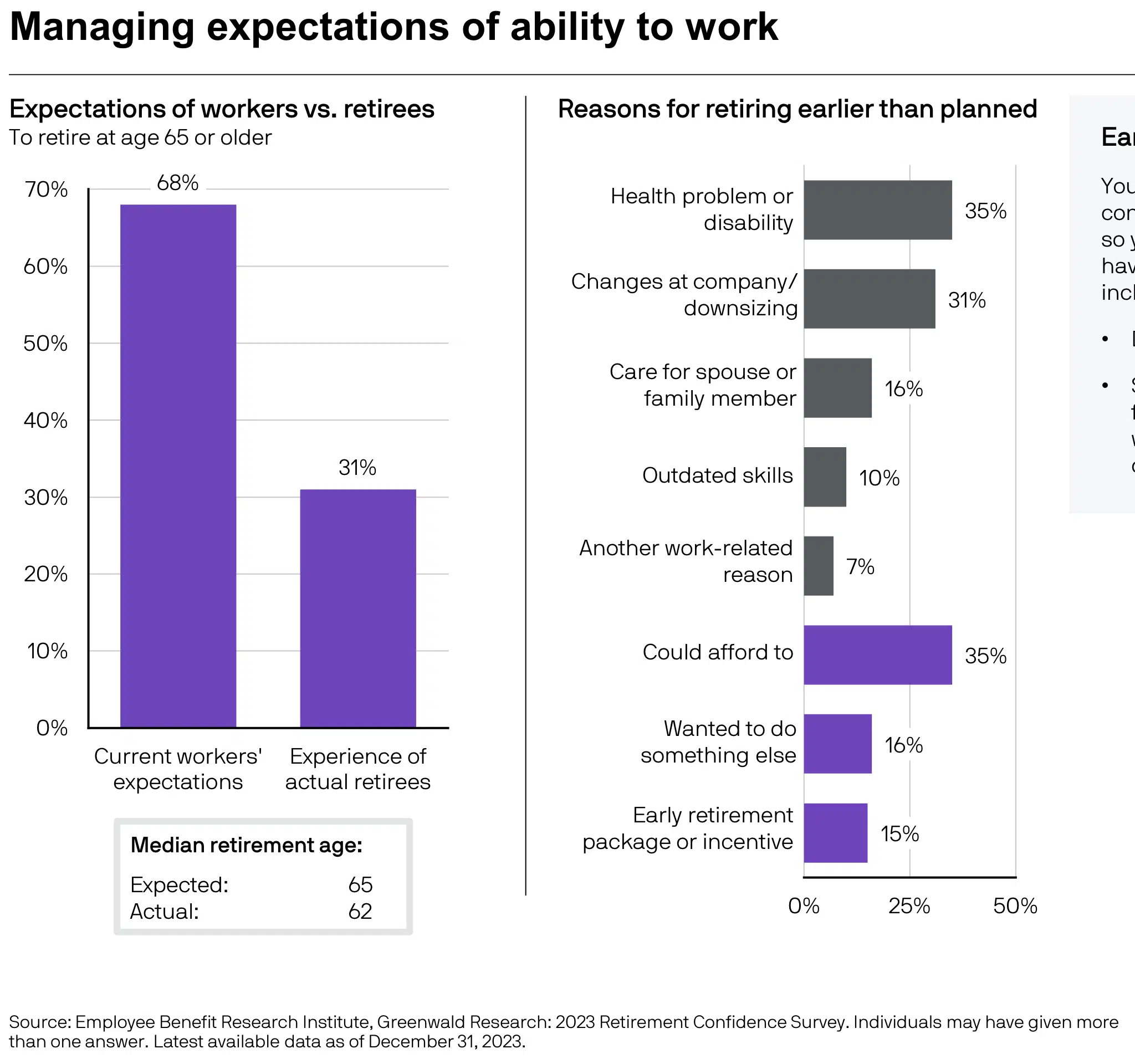

- While 68% of those surveyed expected to work until age 65 or older, 31% achieved this goal (slide 6).

- Of those who households that retired in the 60s, 53% of them have at least one member who some work income (slide 7).

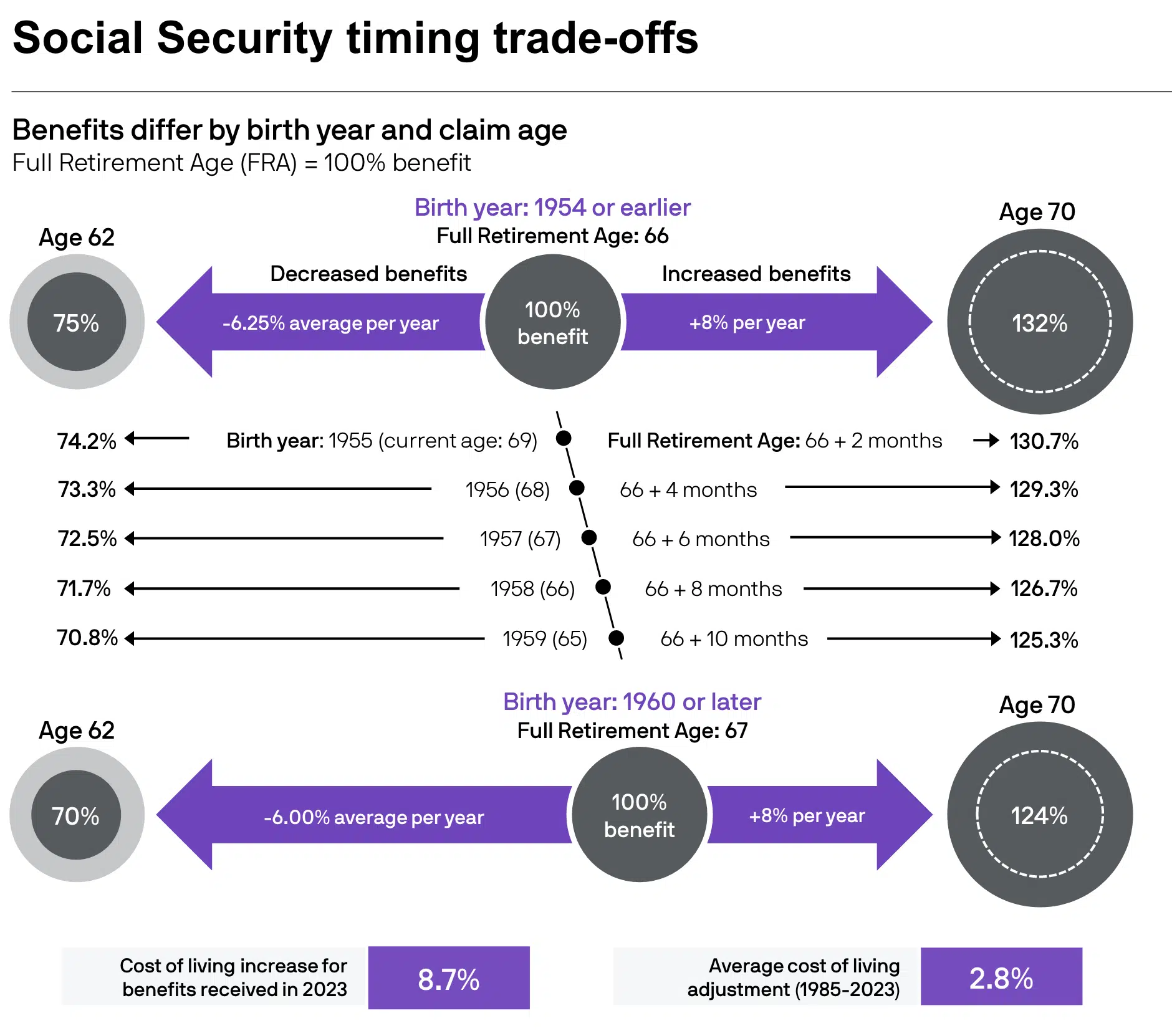

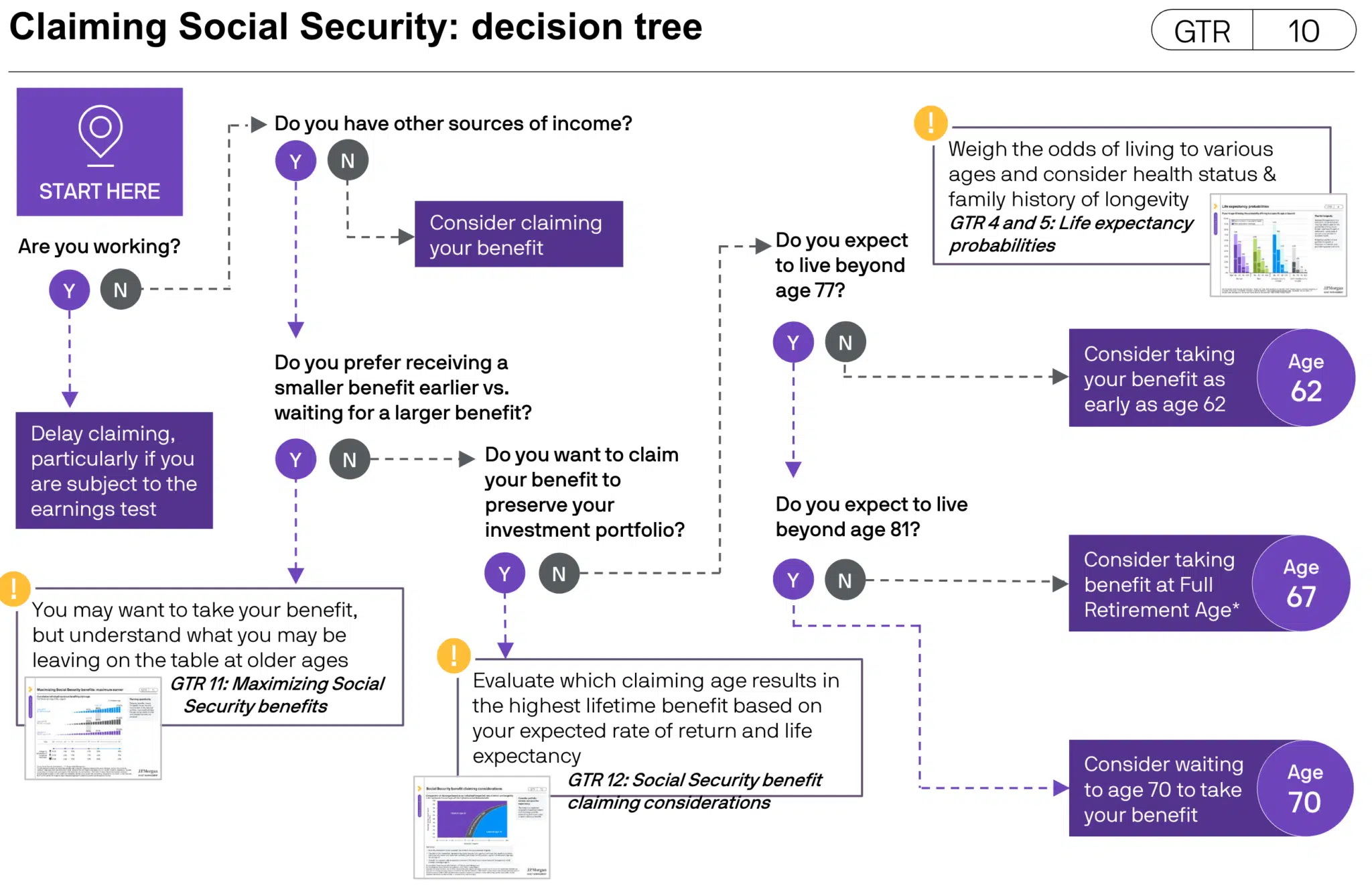

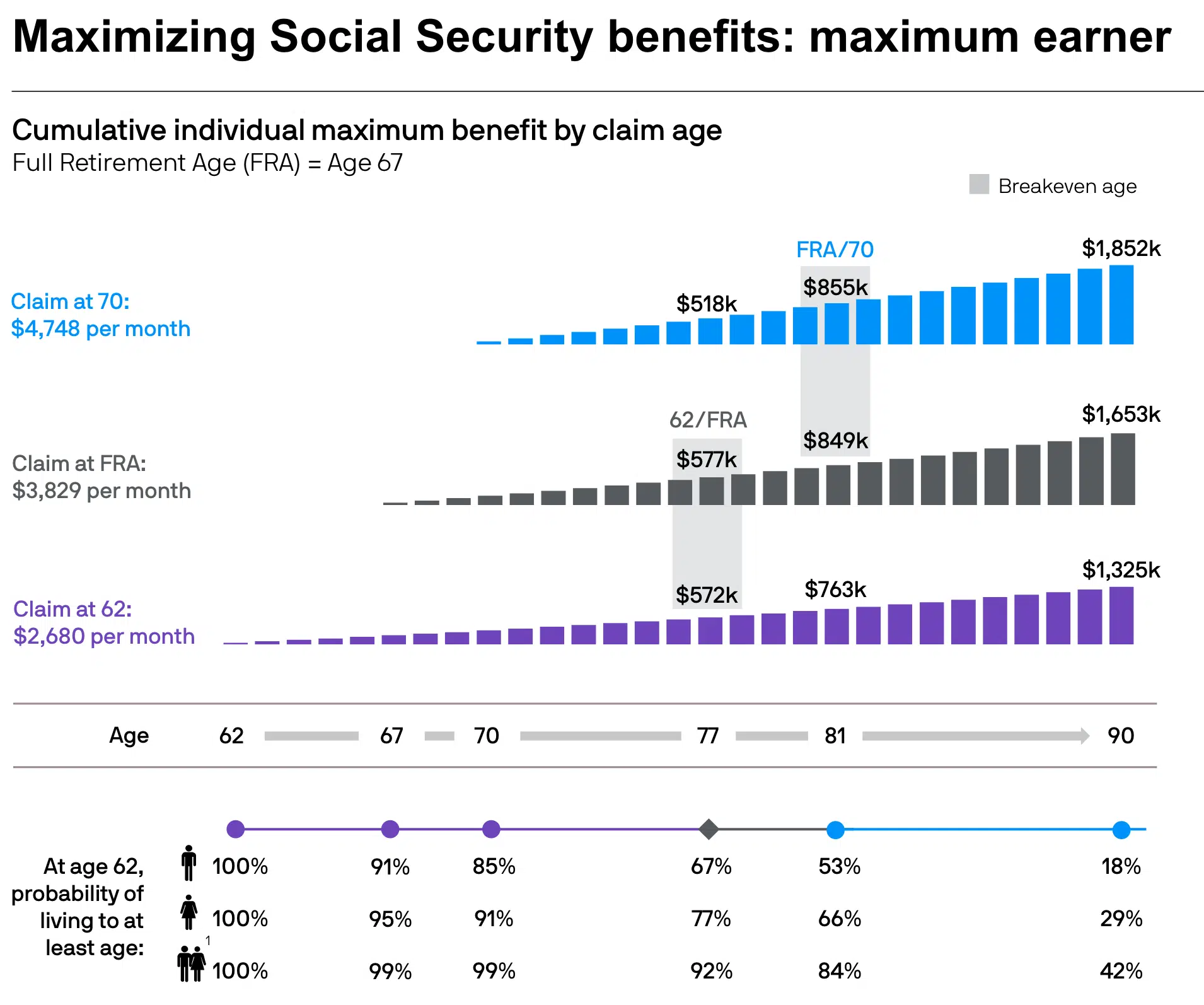

- A Social Security claiming strategy can be found on slide 10 and a comparison of strategies on slide 11.

- Several slides show how much one needs in retirement and how much they should be saving to meet that need based on age and income (slides 13-17).

- The benefits of saving and investing early (slide 19).

- The benefits of automatically increasing your savings each year are life-changing (slide 20).

- There is a suggested order of savings by account type at slide 25.

- Slides 31 and 32 show changes in spending as we age; spending declines significantly in retirement, even as healthcare expenses rise.

- Shows how much retirees would have left after 30 years if they followed the 4% rule (slide 33).

- Introduces the term “dollar cost ravaging” to describe sequence of returns risk and recommends dynamic spending rules as one way to mitigate these risks (slide 35).

- Includes several slides on Medicare strategies, including for those who work past 65 (slides 36 to 40).

- Slide 47 has data on the effects of being out of the market on its best days.