How to Make Retirement Account Withdrawals Work Best for You

Author(s): Roger Young, CFP

Topics:

- Withdrawal Order

Year Published: 2021

My Rating: ⭐️⭐️⭐️⭐️⭐️

One Sentence Summary: T. Rowe Price provides strategies and examples for retirees to maximize their after-tax income by considering the tax implications and time-sensitive nature of their withdrawals from different account types.

Summary

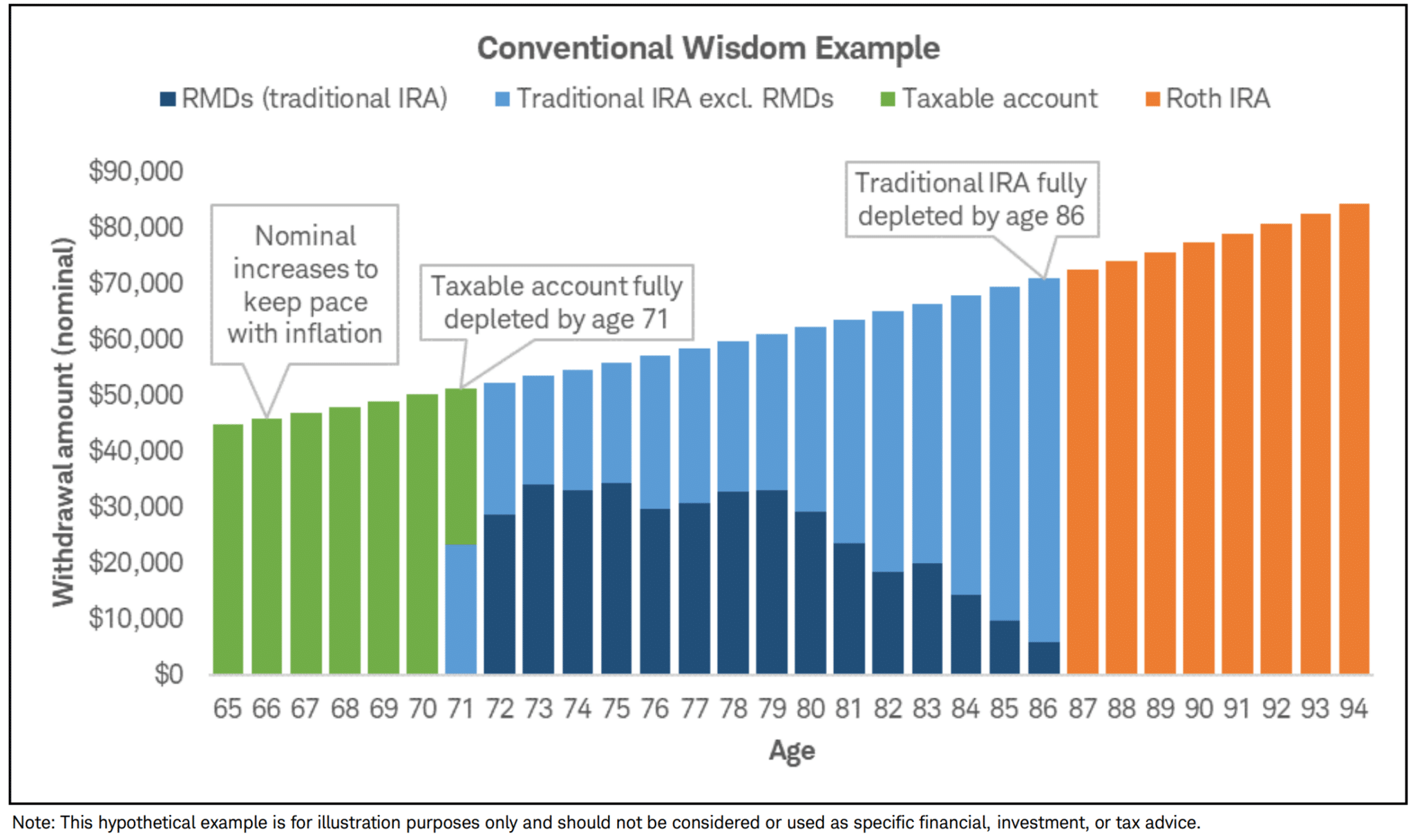

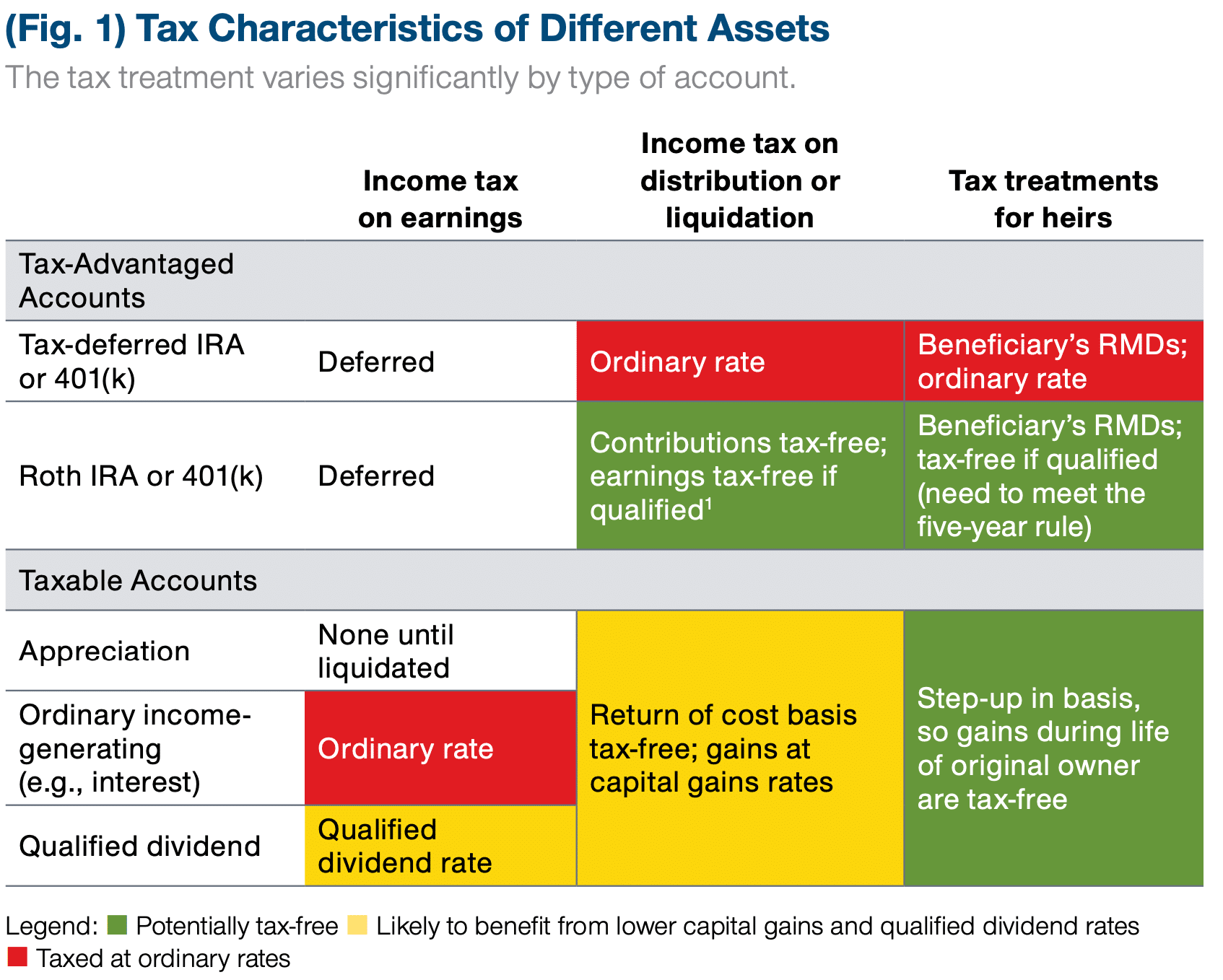

Retirees can optimize their withdrawals from multiple account types to extend portfolio longevity, increase after-tax spending, and maximize after-tax inheritances for heirs. By carefully managing withdrawals, retirees can take advantage of low tax brackets, untaxed capital gains, and the step-up in basis at death.

The paper examines three scenarios:

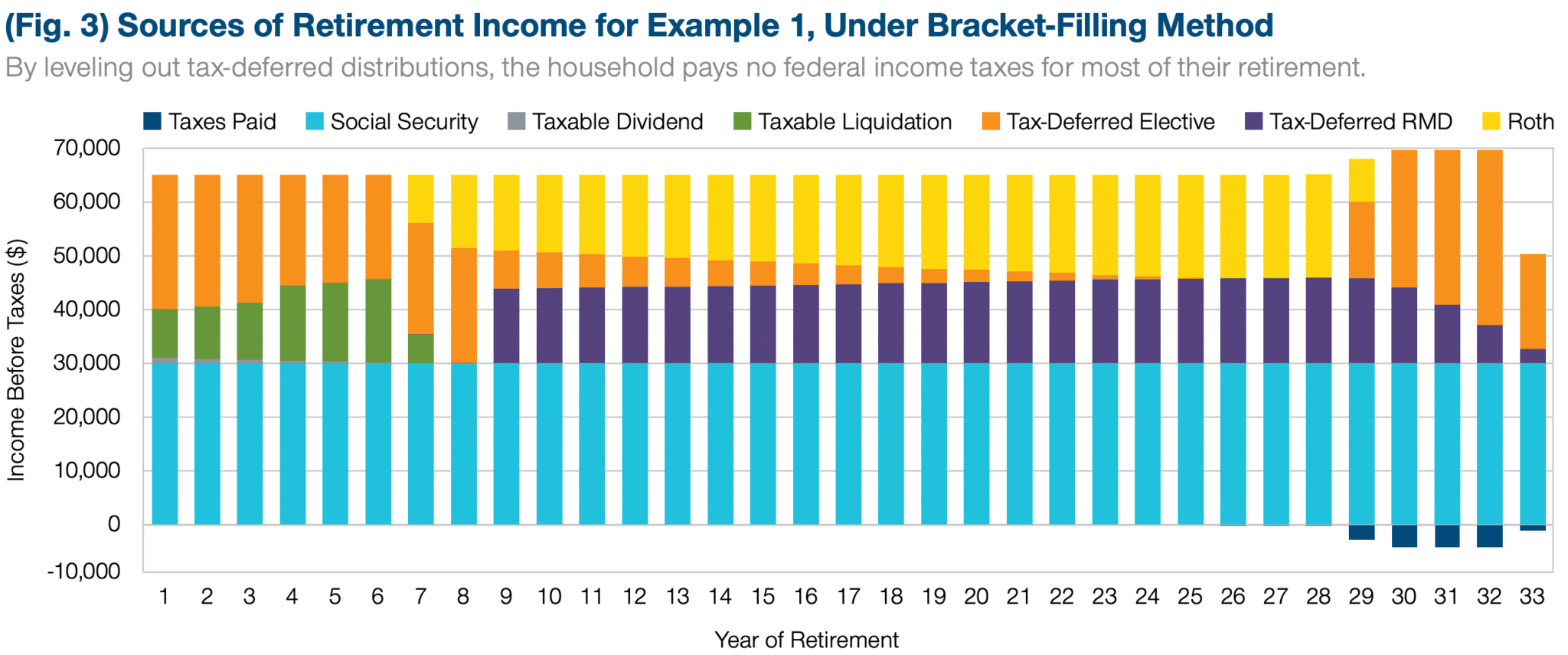

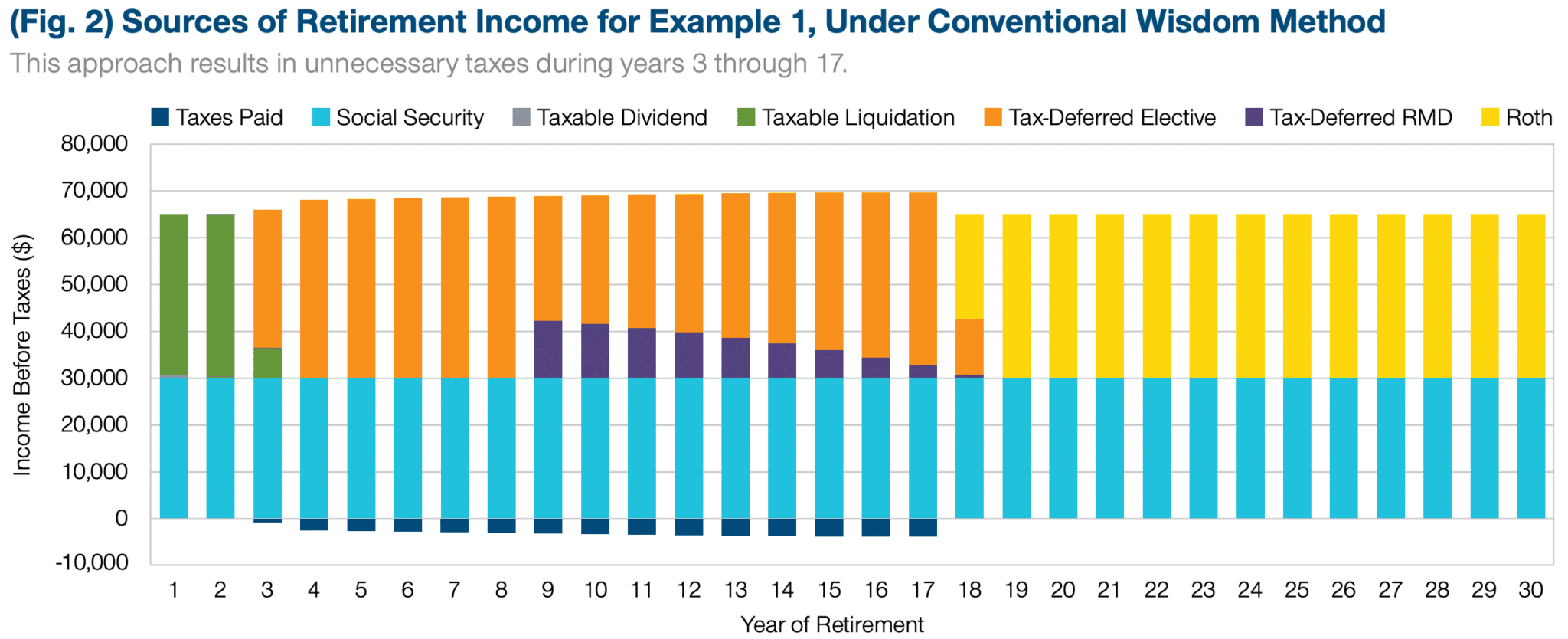

Scenario 1: Modest Income

- Goal: Avoid running out of money and potentially leave an estate.

- Strategy: Focus on spreading out tax-deferred distributions to take advantage of low tax brackets.

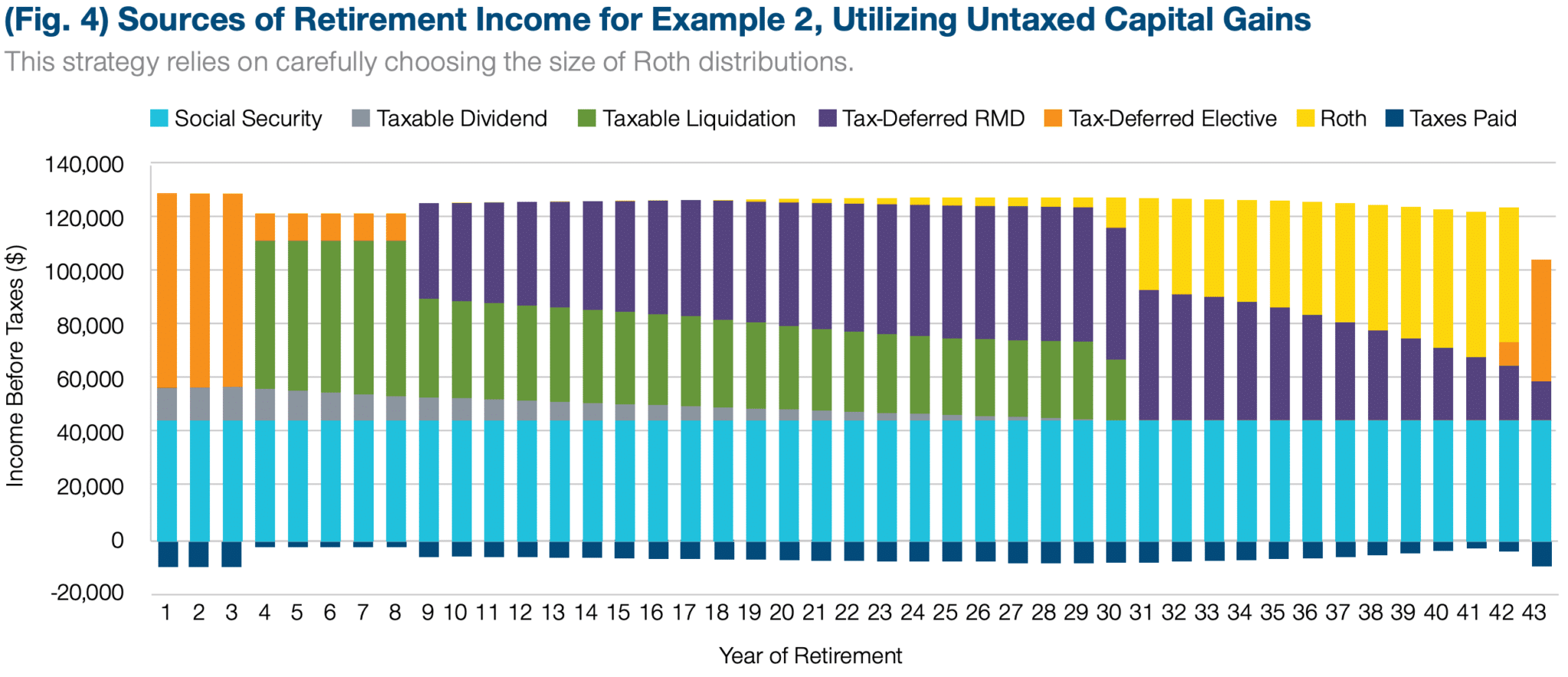

Scenario 2: Affluent with Taxable Accounts

- Goal: Avoid running out of money while leaving an estate.

- Strategy: Consider using untaxed capital gains by selling taxable investments during low-income years.

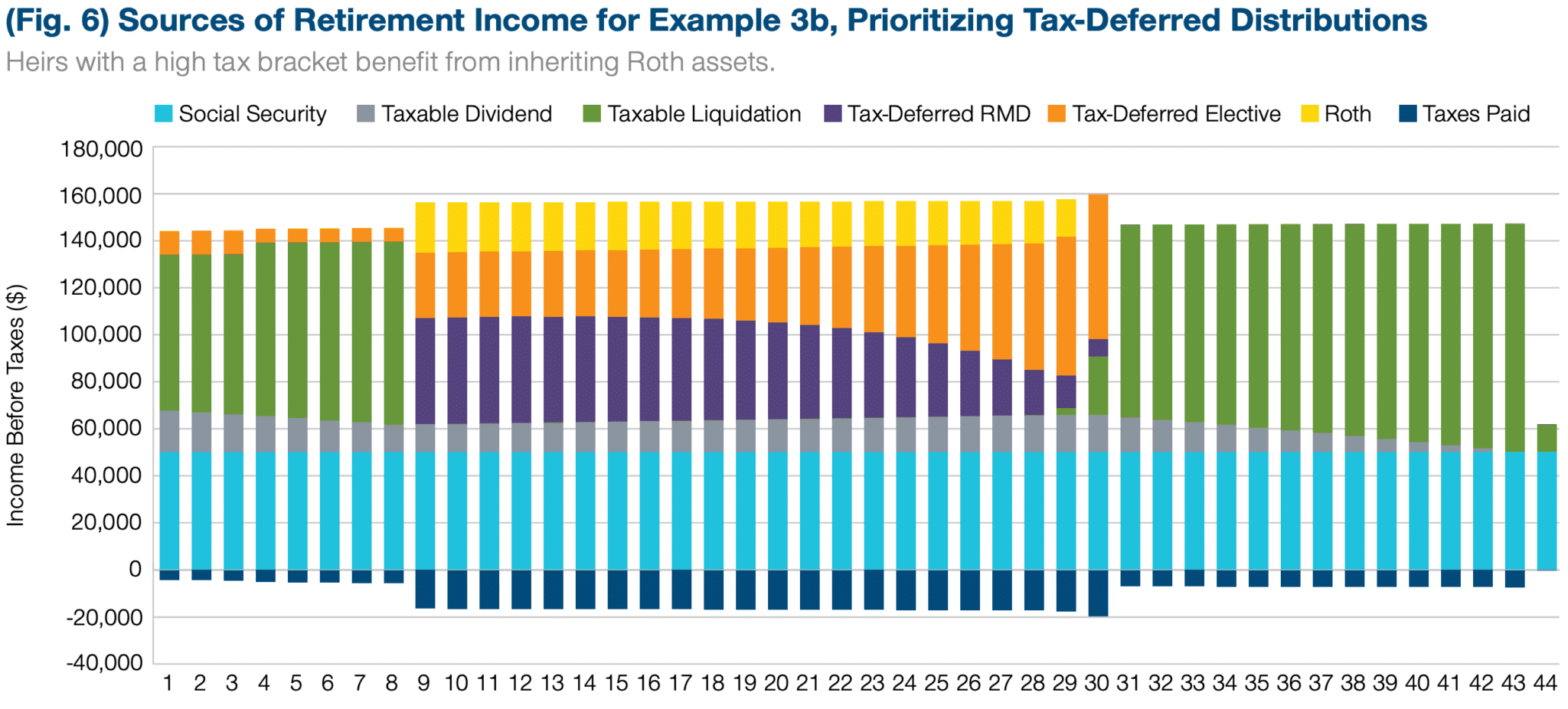

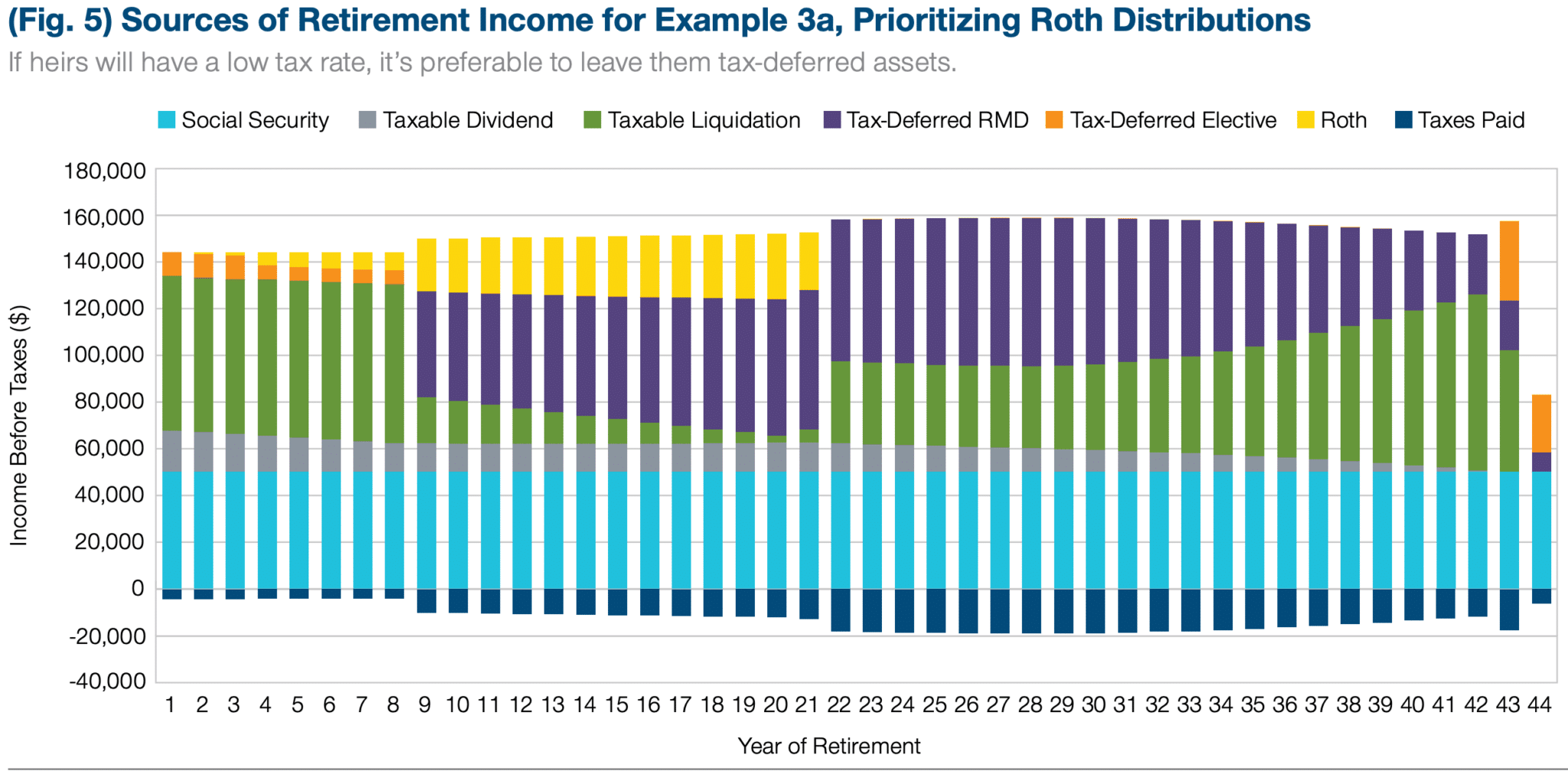

Scenario 3: Estate Planning

- Goal: Maximize after-tax inheritance for heirs.

- Strategy:

- Prioritize Roth distributions to enable untaxed capital gains and leave tax-deferred distributions to heirs.

- Prioritize tax-deferred distributions, using Roth distributions to spread out taxable income.

Key Considerations:

- Tax rates: Federal income taxes, Social Security benefits, dividends, capital gains, and estate taxes all impact withdrawal strategies.

- Heirs’ tax rates: The after-tax inheritance for heirs can be optimized by considering their tax rates when choosing which assets to leave them.

- RMDs: Required Minimum Distributions from retirement accounts can limit flexibility after a certain age.

- Other factors: Retirement age, life expectancy, and risk tolerance also play a role in withdrawal planning.

It’s important to note that the strategies discussed in this paper are not one-size-fits-all. Consulting with a financial advisor is recommended to determine the best approach based on individual circumstances.