Estimating the True Cost of Retirement

Author(s): David Blanchett, CFA, CFP

Topics:

- 4% Rule

- |

- Longevity

- |

- Retirement Spending

- |

- Safe Withdrawal Rates

Year Published: 2013

My Rating: ⭐️⭐️⭐️⭐️⭐️

One Sentence Summary: Spending in retirement does not keep pace with inflation, instead declining on a real basis through mid-retirement and then increasing toward end of life due to healthcare expenses.

Summary

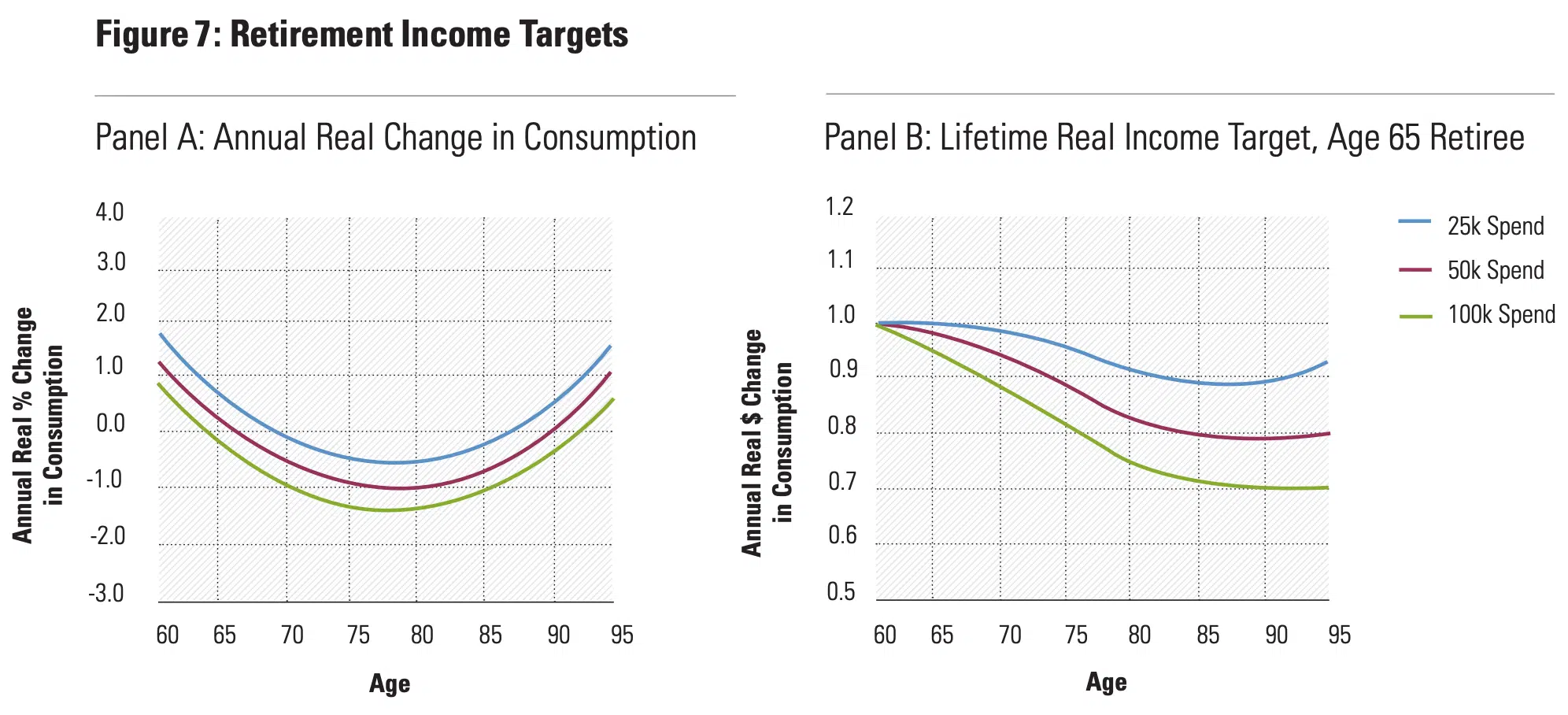

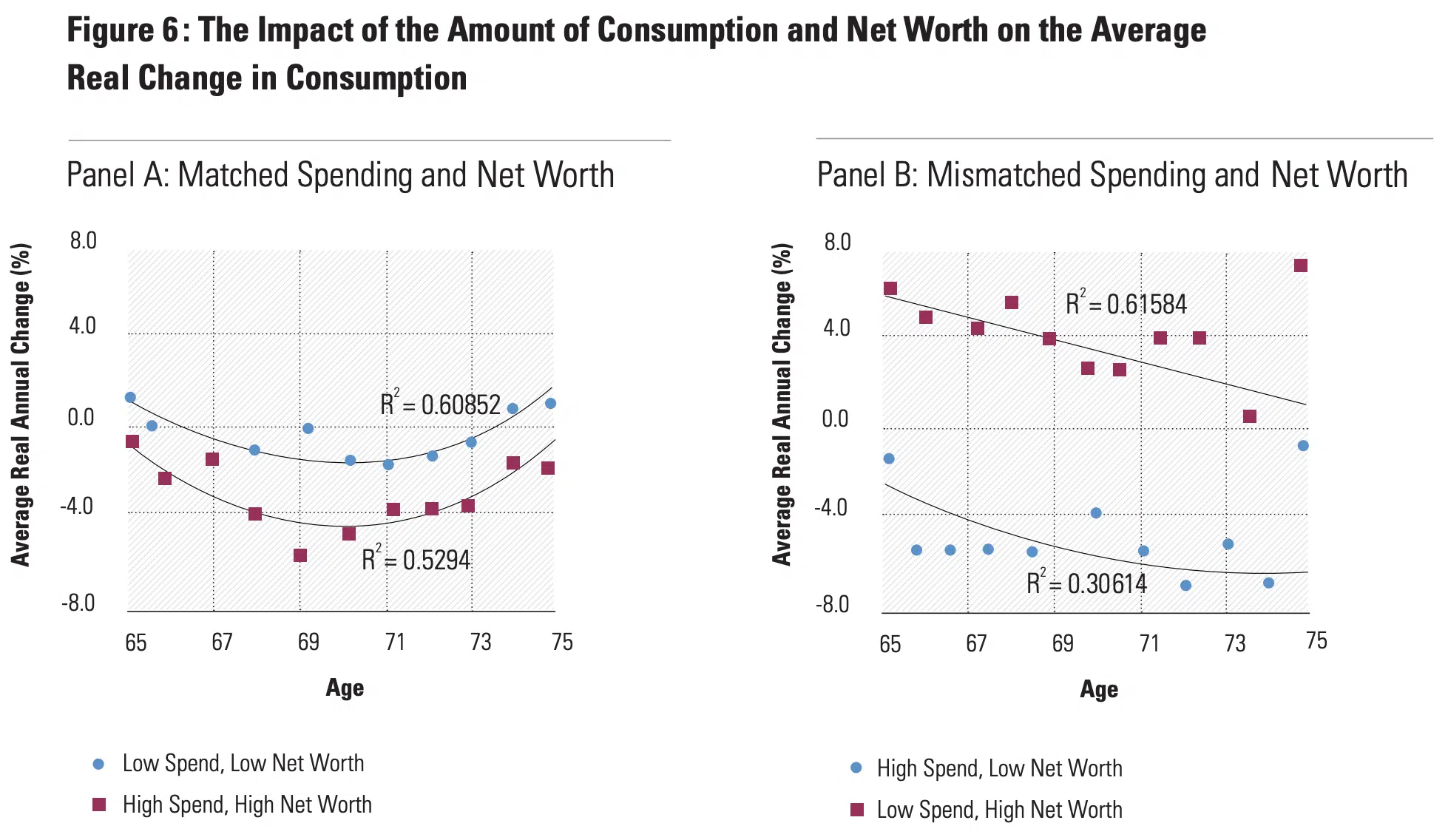

The paper is best known the Retirement Spending Smile, a term the author coined to reflect the observation that spending in retirement tends to decline on a real basis through the first half followed by an upward trend as healthcare expenses rise. Beyond this spending patter the paper has several other important findings:

- The replacement rate (aka replacement ratio), that is the perecentage of pre-retirement income a household needs in retirement to maintain a constant lifestyle is generally 70 to 80%, but can range from a low of 54% to a high of 87%. The variance is explained in part on the pre-retirement expenses one no longer pays in retirement, such as retirement savings contributions and work-related expenses.

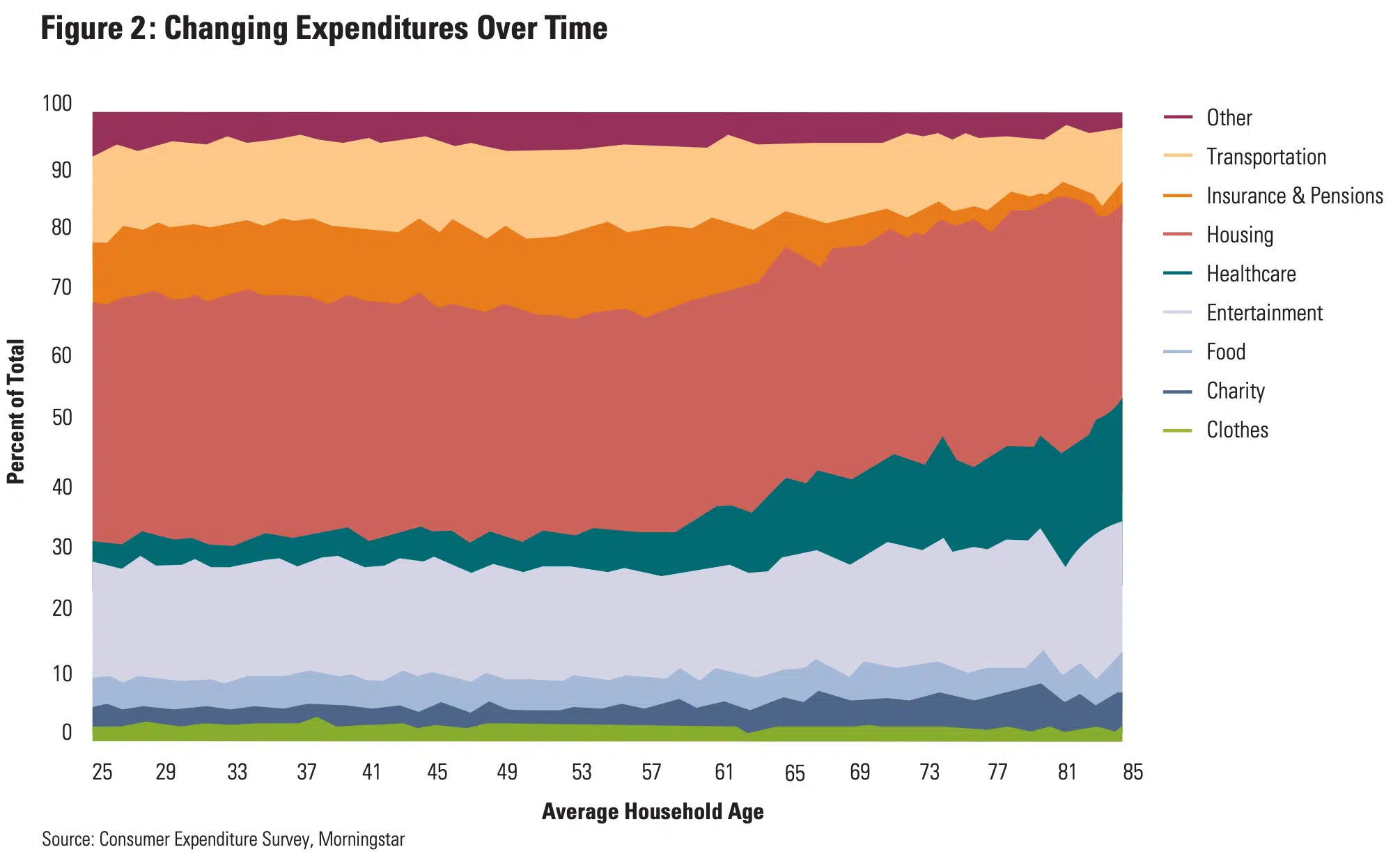

- The median percentage of total expenses spent on medical care is 5% at age 60, rising to 15% at age 80.

- Using a life expectancy model (e.g., RMD calculation) instead of a fixed retirement period significantly increases the initial safe withdrawal rate.

Key Quotes

“We note that there appears to be a “retirement spending smile” whereby the expenditures actually decrease in real terms for retirees throughout retirement and then increase toward the end. Overall, however, the real change in annual spending through retirement is clearly negative.”

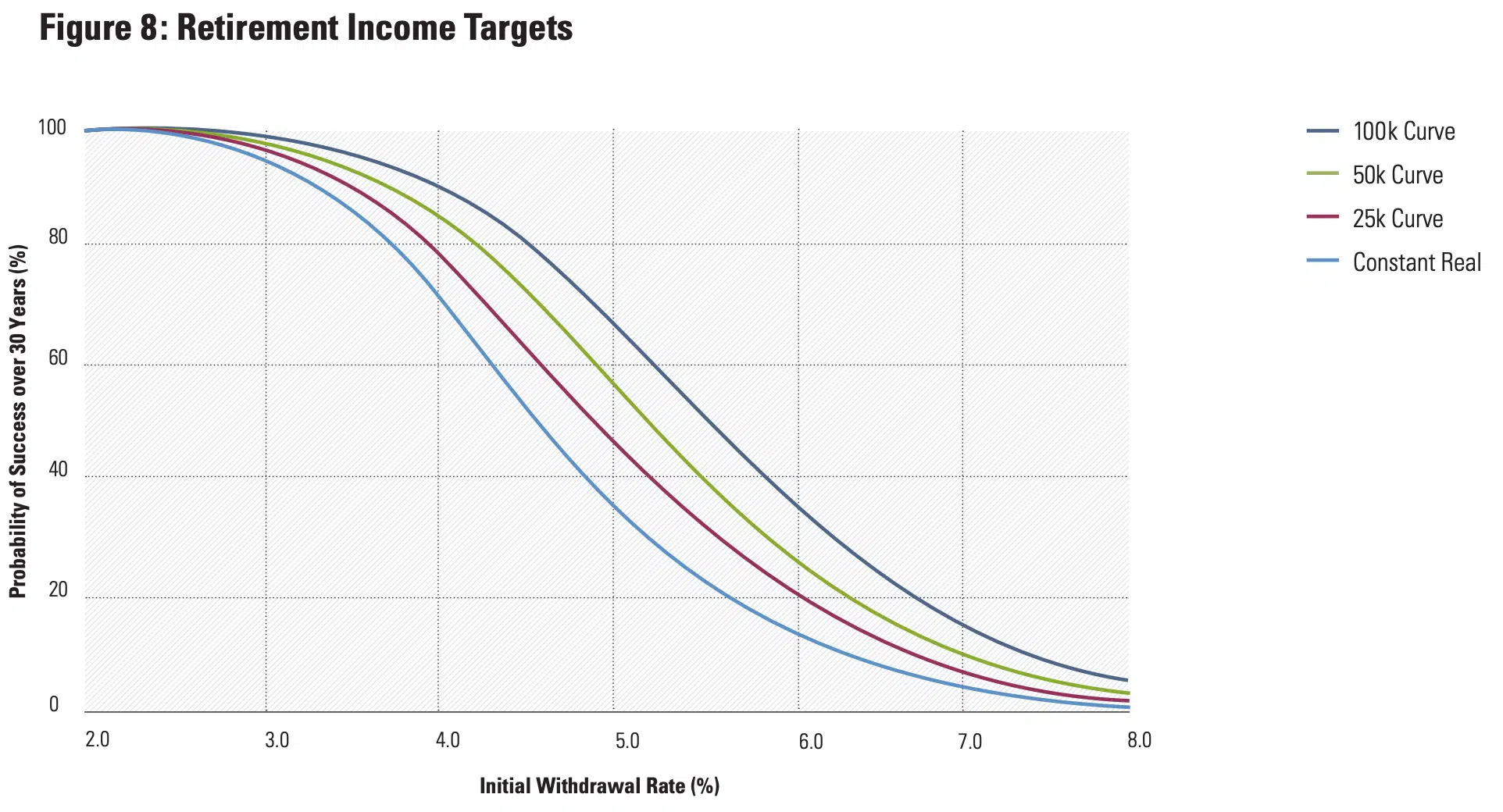

“As we expected, the probabilities of success increase across the different initial withdrawal rates when using the spending curves versus assuming a constant real withdrawal amount increase. For example, a 4.0% initial withdrawal rate has a 73.3% probability of success using a constant real strategy (where the withdrawal increases each year by inflation), while the 25k curve has an 79.9% chance of success, the 50k curve has an 86.0%, and the 100k curve a 91.1%.”