Asset Allocation for a Lifetime

Author(s): William P. Bengen, CFP

Topics:

- 4% Rule

- |

- Asset Allocation

- |

- Early Retirement

- |

- Glide Path

Year Published: 1996

My Rating: ⭐️⭐️⭐️⭐️

One Sentence Summary: This paper follows his famous 1994 paper on the 4% rule and addresses six questions: (1) should retirees reduce their stock allocation each year, (2) what should their asset allocation be at retirement, (3) how the 4% rule works in taxable accounts, (4) taking withdraws in excess of 4%, (5) how early retirement affects the 4% rule, and (6) asset allocation before retirement.

Summary

The paper address the following topics:

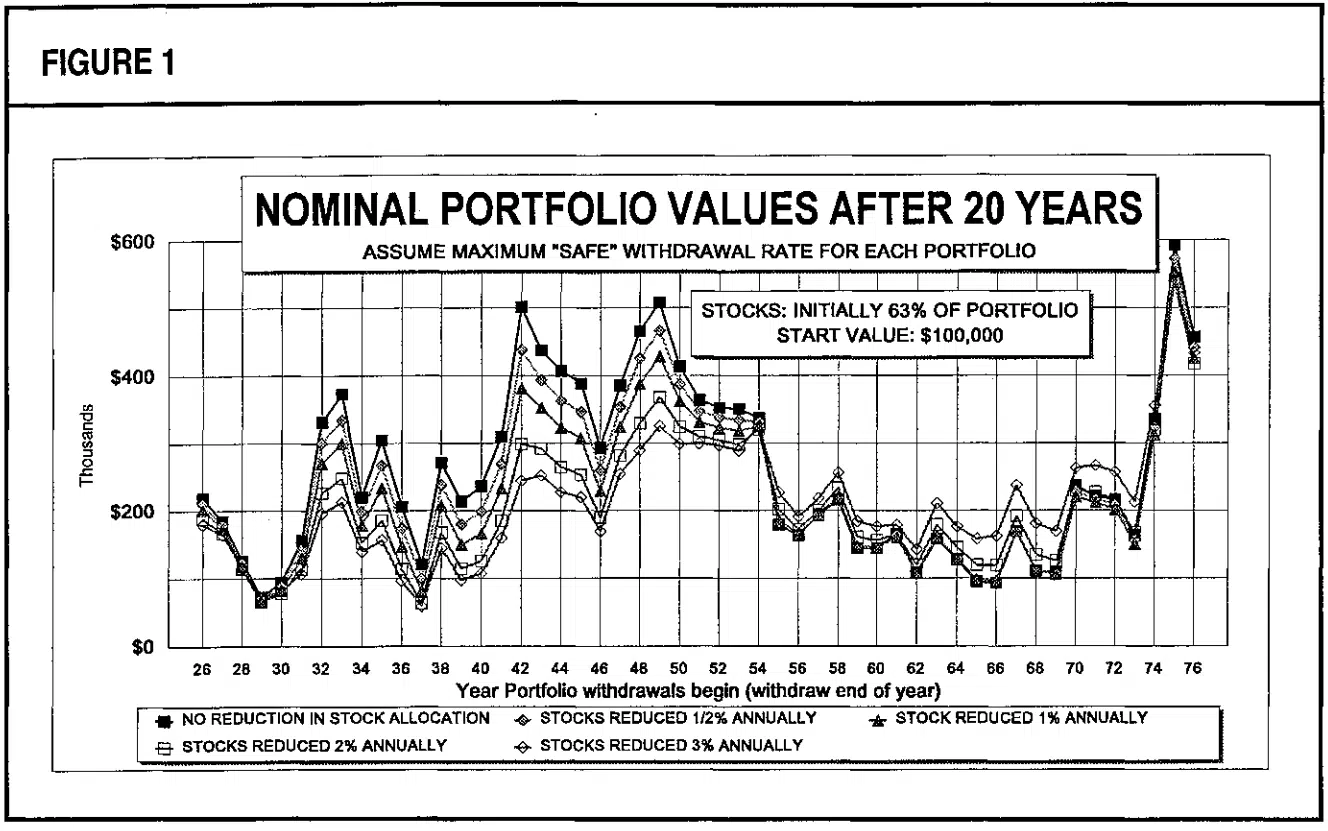

1. Should retirees reduce their stock allocation each year: “All things considered, I recommend that you adopt a phase-down of one percent of your stock allocation each year, shifting it into intermediate-term bonds. This is a subjective recommendation, in that the one-percent phased portfolio looks like a good compromise between growth of wealth, withdrawal rate, and late-retirement volatility. It satisfies my personal “Goldilocks test”: neither too big, nor too small, but just right. You may build less wealth than otherwise if the markets are strong, but you will be spared considerable pain in a major market event later in retirement. And you can use virtually the same withdrawal rate as you would have had with the zero-percent phased portfolio.”

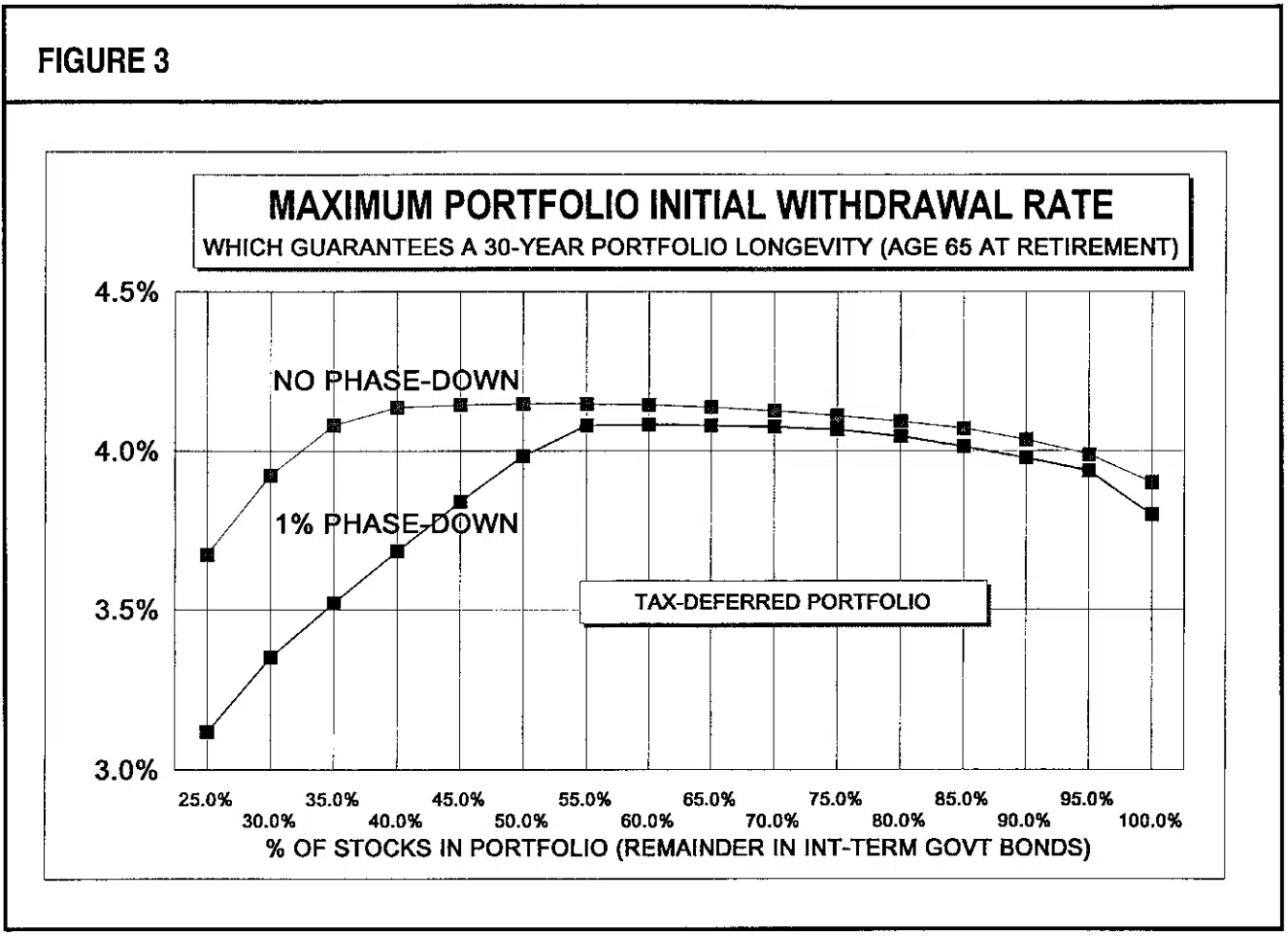

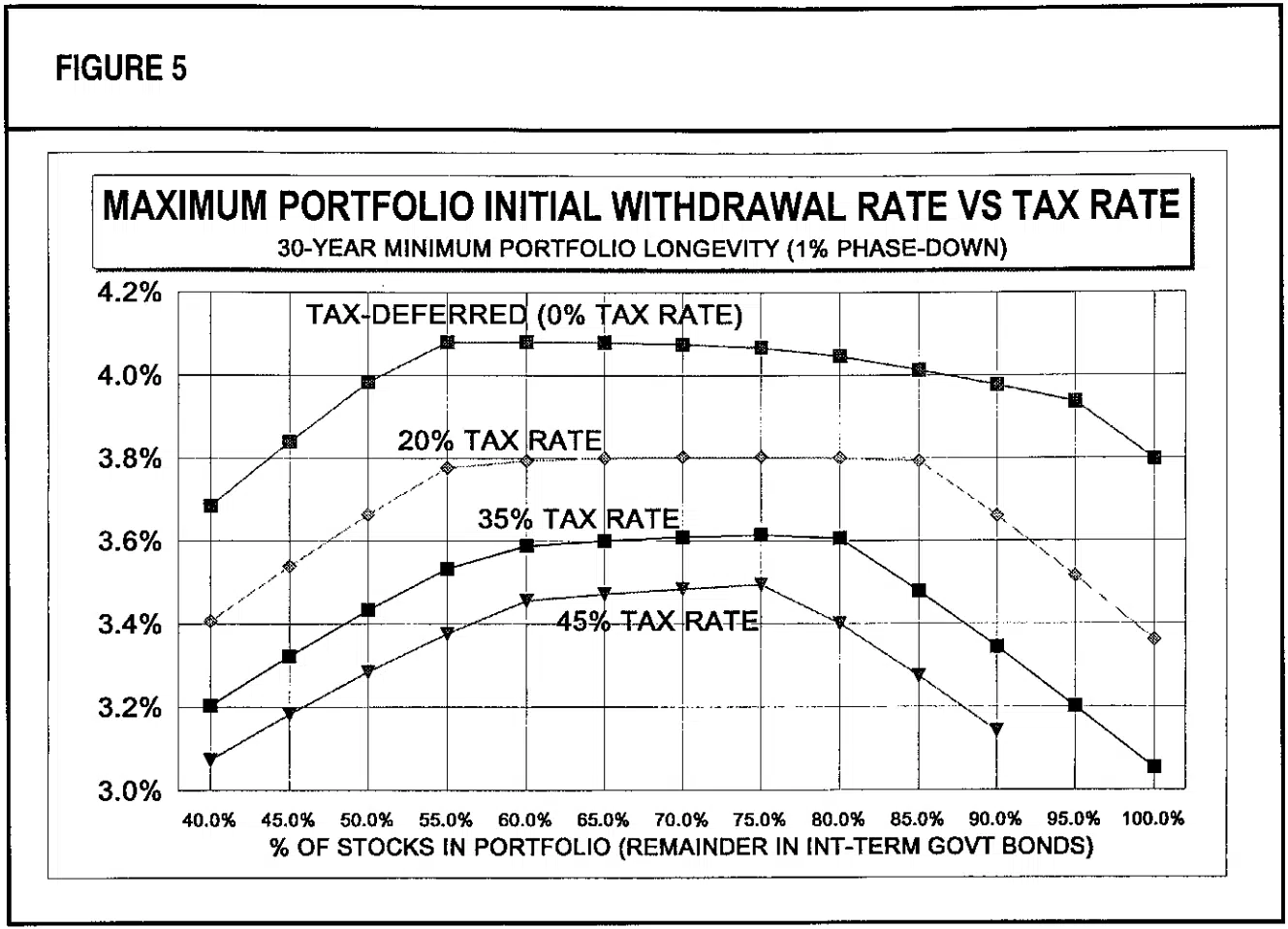

2. What should a retiree’s initial asset allocation be at retirement: “I recommend a starting percentage of 63 percent in stocks [for moderate risk investors], which is in the middle of the range of 50-percent to 75-percent stocks. For conservative risk investors, I would recommend a 50 percent allocation of stocks to address their abiding fears of a stock market decline. For aggressive-risk investors interested in maximizing wealth to pass on to their heirs, I might recommend the maximum 75-percent stock allocation. All investors can use the same initial withdrawal rate, about 4.1 percent.”

3. How the 4% rule works in taxable accounts: “Note that the top line of the chart, for zero-percent tax rate, is the result I gave in my earlier research for taxdeferred accounts. It maxes out at about 4.1 percent for a stock allocation of about 55 percent. It is clear from the chart that as the tax rate is increased, the maximum withdrawal rate declines. This matches expectations, because the portfolio is earning ever lower after-tax rates of return as the tax rate climbs. Withdrawals must thus be reduced to preserve portfolio capital.”

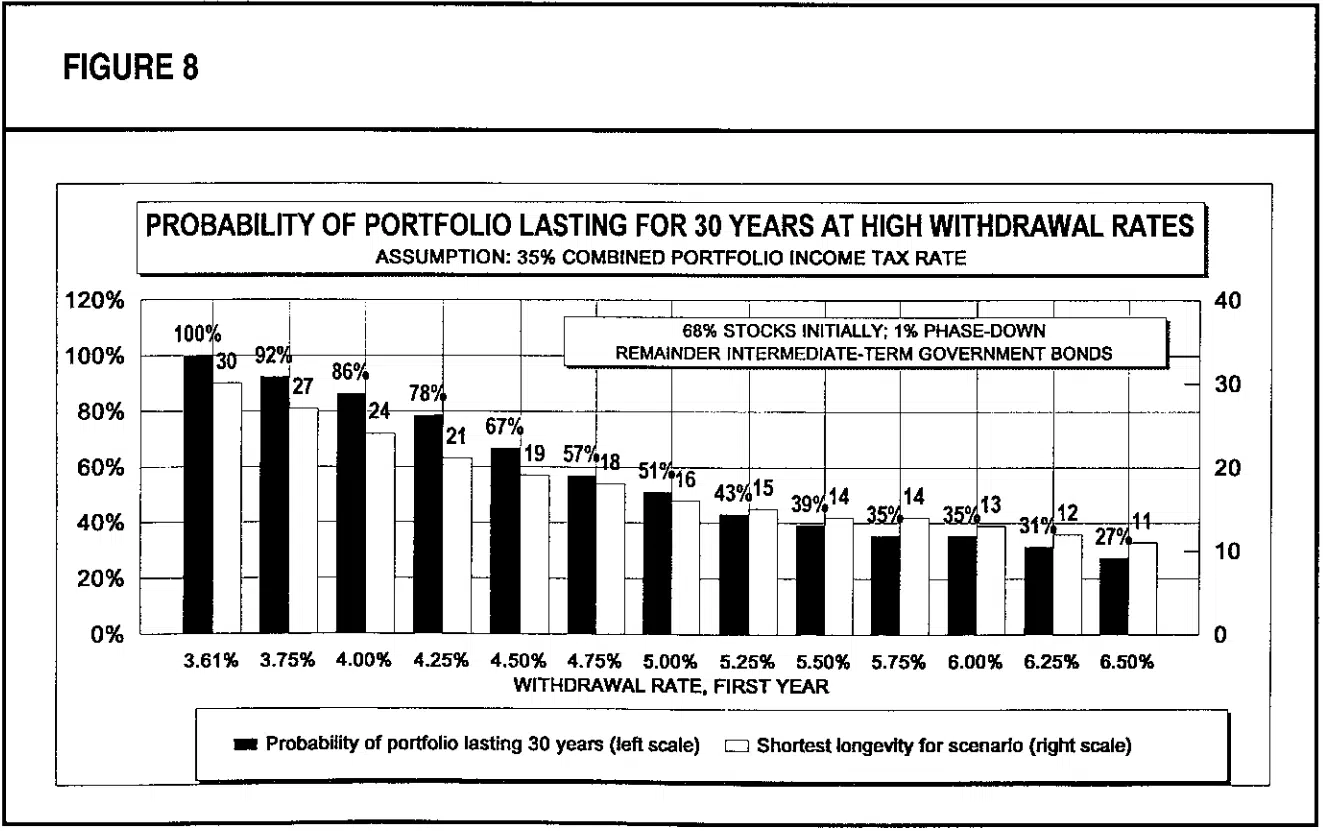

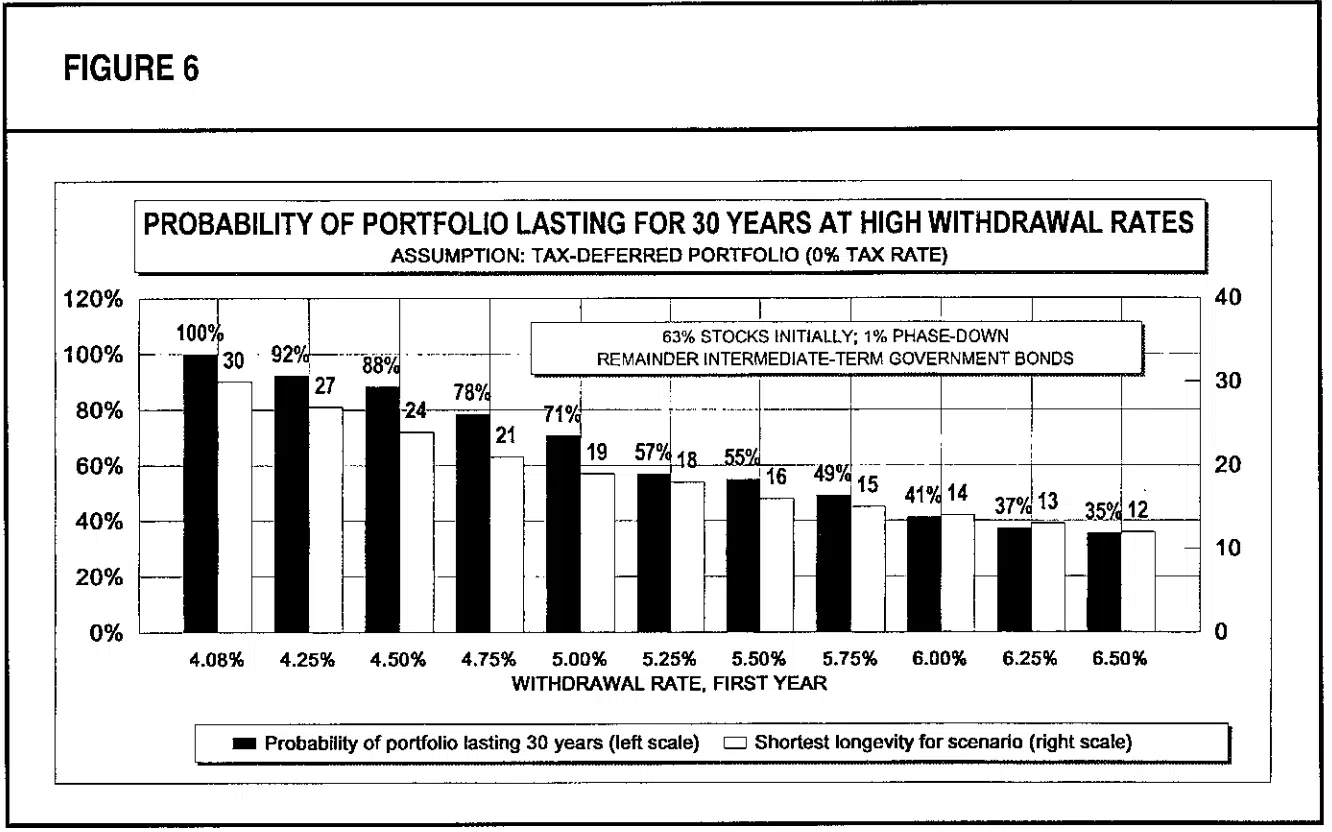

4. Can a retiree take withdraws in excess of 4%: “Thus, for the purpose of deciding by what percentage to exceed the “safe” withdrawal rate, the probabilities of making it through retirement are about the same for tax-deferred and taxable portfolios. You can choose from these charts the odds you feel comfortable with, and we can adjust your initial withdrawal rate accordingly. I would advise you to be careful with any withdrawal rates having a probability of “success” much less than 85 percent, which corresponds to an increase in withdrawals above the “safe” level of about 11 percent, and a minimum portfolio longevity of about 24 years. . . .”

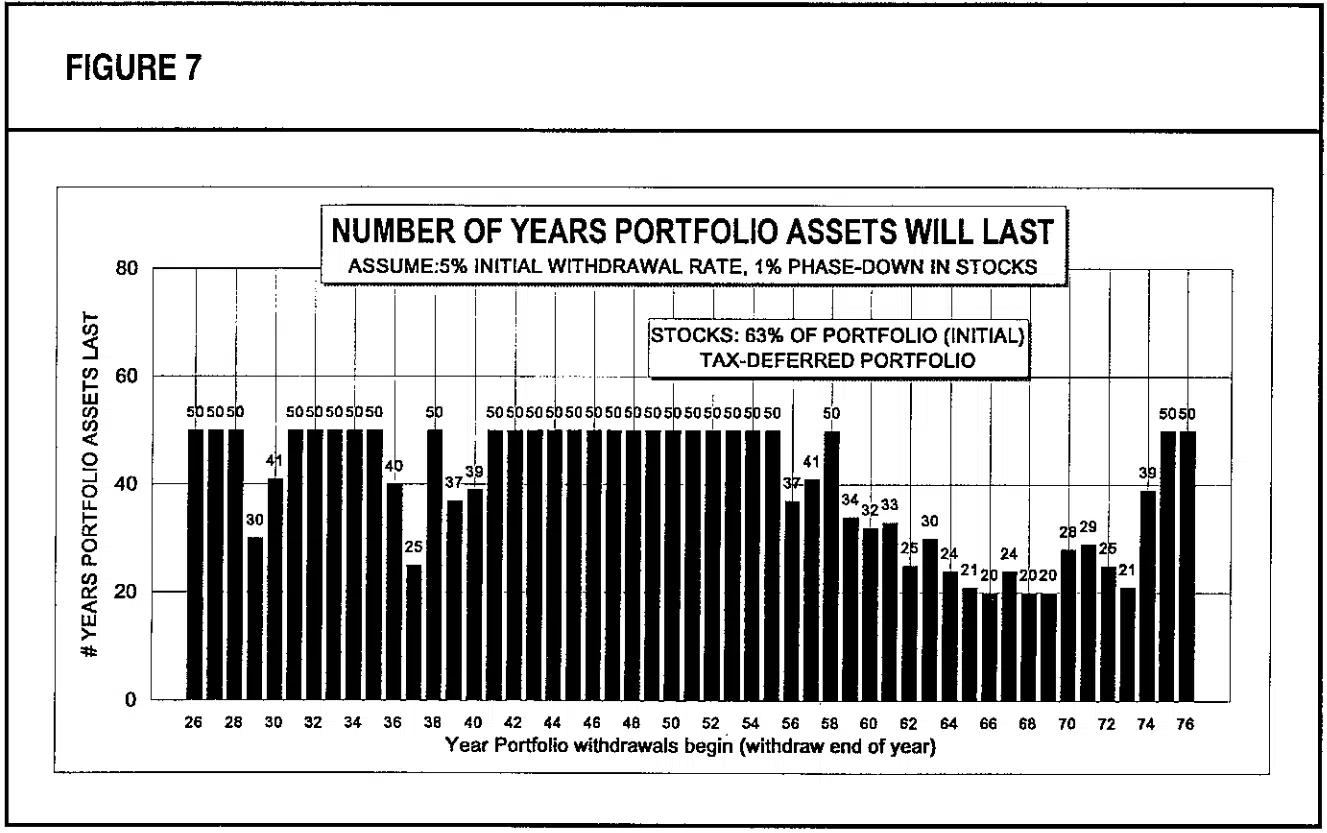

5. How early retirement affects the 4% rule: For a person retiring at age 50 and expecting a 45-year retirement, the initial safe withdrawal rate falls to 3%. In addition, Bengen recommended the following asset allocation: “I will reduce your stock by one percent a year, according to the following formula: % of portfolio in stocks = 115 minus your age for conservative investors, % of portfolio in stocks = 128 minus your age for moderate risk, and % of portfolio in stocks = 140 minus your age for aggressive investors.

6. What’s the ideal asset allocation before retirement: Lifetime asset allocation for virtually all clients can be managed through use of the following two asset allocation equations: Tax-deferred accounts: % of portfolio in stocks = ( 115 to 140) minus your age Taxable accounts: % of portfolio in stocks = (120 to 145) minus your age.