5 Best Budgeting Apps for Couples

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

By Rob Berger, JD | January 1, 2026

Money can’t buy love, but managing it well can buy peace of mind when you and your spouse are on the same page. Whether you’re splitting bills, juggling monthly expenses, or saving for your first home, managing money as a couple is no small feat. Today’s money tools for couples aren’t just personal finance apps, they’re relationship savers.

From setting goals to customized dashboards and even emoji-filled chats, these apps make talking about money less stressful and more productive. Let’s dive into five personal finance apps built for two.

Editor’s Pick

Monarch Money is the budgeting app my wife and I use. It earns its spot as an editor’s pick due to its features allowing couples to manage money together with ease. Couples can link both joint and individual accounts, have separate logins, and see a comprehensive view of their household finances. The app allows partners to tag each other on transactions, set shared financial goals, and track progress together.

Monarch Money also offers customizable budgeting tools and detailed reports to analyze spending patterns. Its user-friendly interface and emphasis on joint financial planning make it an excellent choice for couples aiming to manage their money together.

NEW: Monarch has just released its Filter by Owner feature. It enables you to designate accounts and transactions has “owned” by you, your significant other, or both. You can then use a drop-down to select whether to view your accounts/transactions, your significant other’s, or both. I’ve used it and it works as you would expect.

App Store Rating: 4.9 (50k reviews)

Platforms: Apple iOS, Android or Web

Best for couples managing joint and individual accounts who want to collaborate in a shared space.

Limited Time Offer: Get 50% off of Monarch Money the first year with the code ROB50.

Personal Finance Apps for Couples

1. Monarch Money

Monarch Money offers collaborative financial planning tools for couples. These features include the following:

- Separate Logins: Each partner sets their own login credentials and can use two-factor authetication.

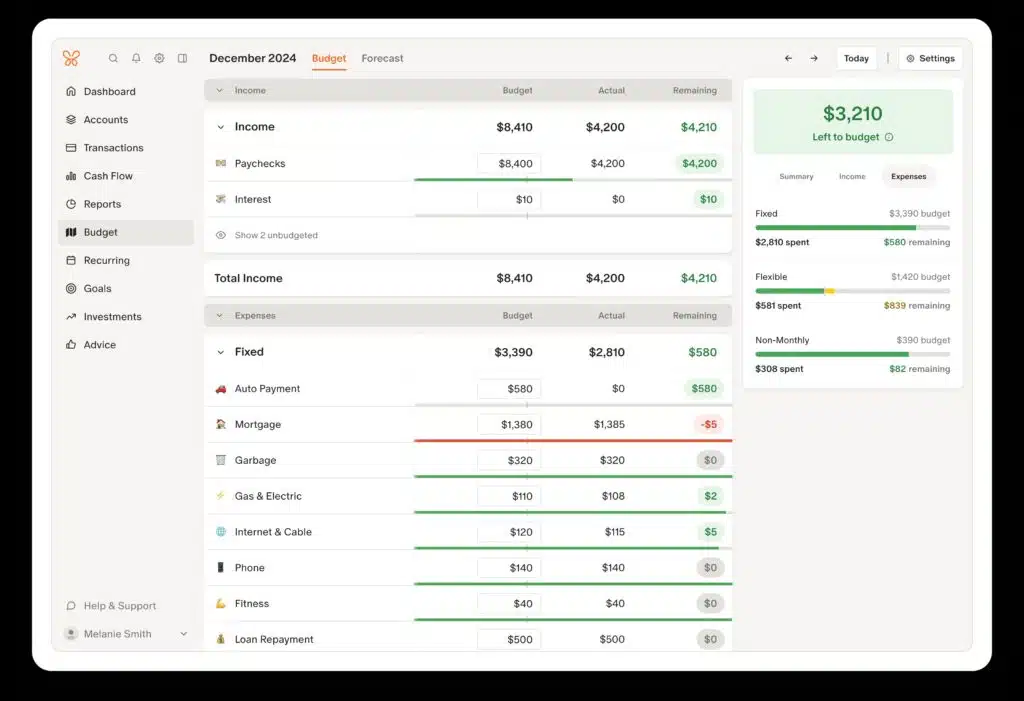

- Shared Dashboard: A single dashboard brings together all accounts, budgets and goals.

- Accounts: Connect both individual and joint accounts

- Transaction Review: Tag your partner on specific transactions that need reviewed

- Goals: Create and track shared goals

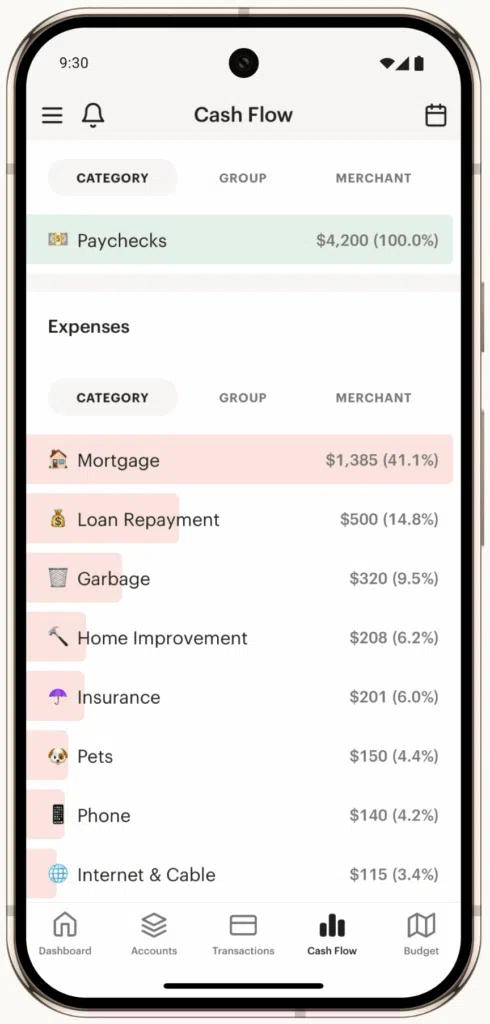

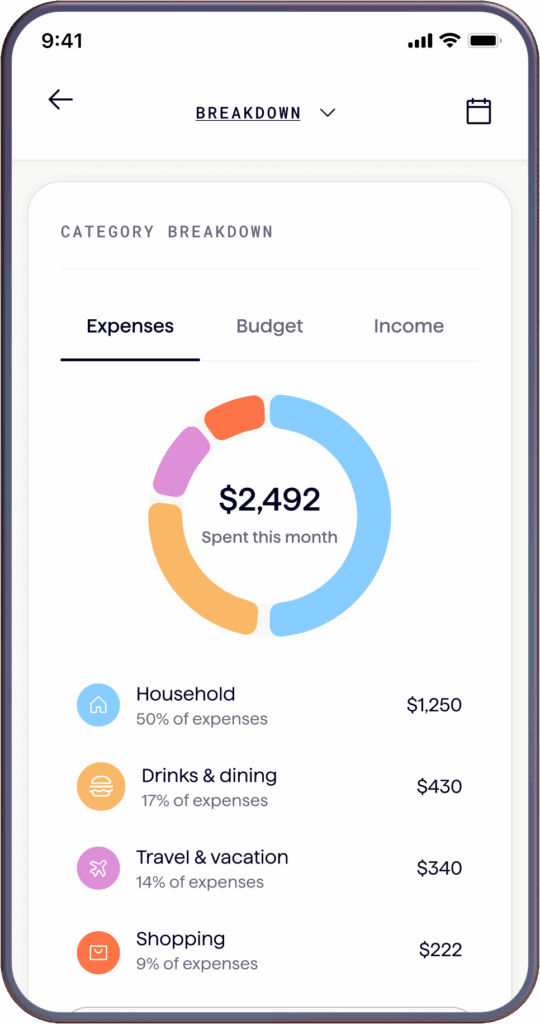

The app provides customizable dashboards and reports that show where your money is going to help you figure out where to cut back spending if needed.

One of the stand out features of this app is it offers two ways for couples to budget. You can choose Flex Budgeting which tracks your Fixed, Flexible, and Non-Monthly spending. Some couples may find this easier than assigning a budget to every type of spending category. But, couples can also choose Category Budgeting and assign a fixed amount to each spending category.

Another excellent feature is the ability to tag your partner on transactions to have them review a charge or to identify who made the charge. It also supports manual and automated data entry. Monarch offers a one-week free trial.

Cost: The cost is $14.99/month, or discounted annually for $99.99 ($8.33/month). For a limited time, it is offering a 50% discount off the first year. Just use the Discount Code: ROB50.

Best for: Couples who want a sophisticated tool to manage and budget finances together in a visually appealing, customizable platform.

2. Origin

The Origin app offers several features to help couples manage their money together. These include:

- Separate Logins: A user can invite their significant other from within the Profile section of the app. I added my wife and it took just a few seconds.

- Separate & Joint Accounts: Accounts can be marked as separate or joint. Each user can toggle between views of joint accounts or their individual accounts.

- Shared Budgets: Couples can create shared budgets and track spending together.

- Shared Financial Dashboard: Budgets, goals, net worth and other financial data is available in a single, shared dashboard.

- Account Toggle: Easily toggle between viewing all accounts, just your accounts, or just your partner’s accounts.

Origin is unique among all of the budgeting apps I’ve ever tried (including all of the apps on this page). For starters, it does a lot more than just budgeting. For example, with Origin you can:

- Track your investments

- Invest with index funds

- Save cash with a competitive APY

- Do your taxes

- Create a will

- Create a trust

- Talk to a Certified Financial Planner

- Track shares, RSUs, ISOs, and NSOs

- Understand potential tax implications

- Simulate exercising stock options

Most of these features come with the monthly or yearly subscription fee. For example, Origin includes tax software that comes with your subscription. Those features that require additional fees, such as creating a trust or talking with a CFP, are reasonably priced in my view.

Beyond these features, Origin has also integrated AI into its app. You can use AI to ask questions about your budget. It’s one of the most advanced and feature-rich money apps I’ve ever used.

Origin offers a 7-day free trial, after which the cost is either $12.99 a month or $99 a year ($8.25 a month).

3. Simplifi by Quicken

Simplifi is a modern budgeting and financial tracking app that emphasizes ease of use, real-time alerts, and AI technology. It offers several features designed for couples:

- Shared Spaces: A user can invite one additional person to join the app for no additional cost. Simplifi calls this “Spaces & Sharing.”

- Separate Logins: Each user gets their login credentials.

- Shared Dashboard: Both users have full access to Simplifi’s dashboard, which brings together in one place a high-level view of your money.

- Joint and Individual Accounts: Users can link both joint and individual accounts.

- Shared Budget: Both users have full access to the shared budget and expense tracking.

There’s no dedicated couple mode, but it does allow for one person to be added to an account using the “spaces & sharing” option. You can also track your investment balance and performance in the app. There’s no free plan but it is one of the more affordable options.

Cost: Regularly $5.99/month, but currently available for $3.99/month, billed annually.

Best for: Couples seeking a simple, affordable, intuitive, and automated budget app without complex investment tracking.

4. Rocket Money

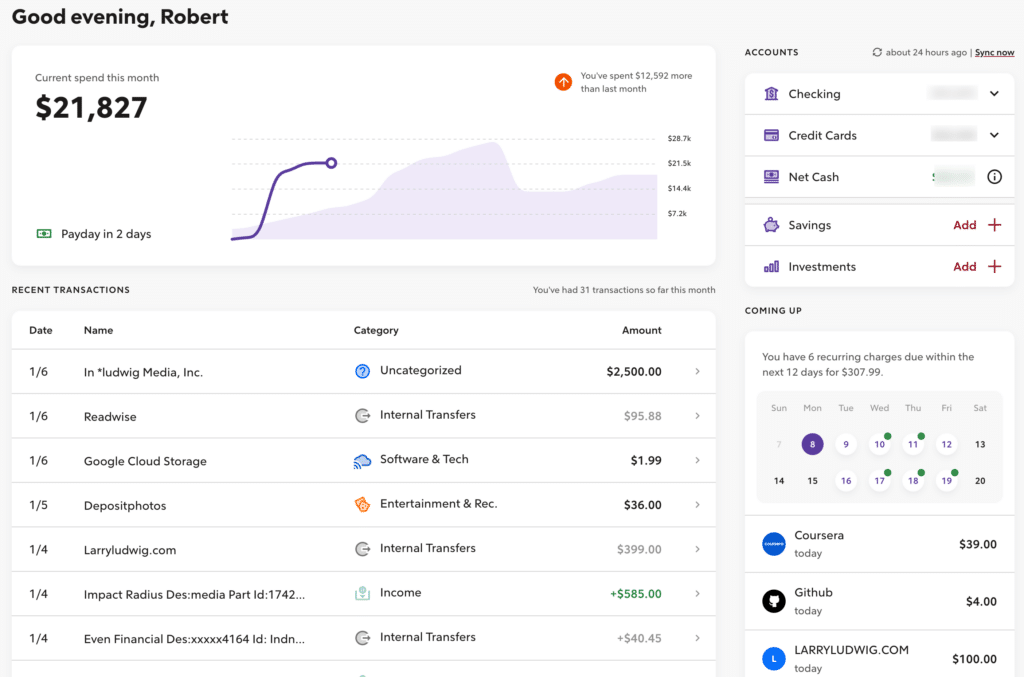

I started using Rocket Money for both our personal and business budgets last year. While I switched to Monarch Money, I still think Rocket Money is an excellent option. Having used both its web and smartphone apps, I can tell you it’s one of the best-looking and easiest-to-use budgeting tools available. On top of that, you can get the premium version for as little as $7 a month.

Features designed for couples include the following:

- Separate Logins: Separate logins each with two-factor authentication

- Shared Budget: Jointly create and adjust budgets

- Dashboard: One unified dashboard for individual and joint accounts

- Notes: Add notes to transactions available to all users

As for budgeting, Rocket Money does the basics well. It’s easy to track your spending and set up budgets. It’s easy to create rules for automatically categorizing transactions. And it’s easy to connect your investment accounts if you want to.

Here’s what the dashboard looks like for my business (it looks the same for personal expenses):

It gives me a snapshot of everything I need to manage my money. Rocket Money keeps track of subscriptions and makes it easy to cancel them. It’s an excellent Mint replacement, particularly if you focus on budgeting.

Key Features

- Subscription management

- Calendar budget

- Bill negotiation

- Net worth tracking

- Credit score monitoring

- Investment tracking

- Spending goals

- Budgeting

Rocket Money offers a free and paid version. The paid version costs $7 to $14/mo based on what you choose to pay them. Seriously.

5. YNAB (You Need a Budget)

YNAB is a premium budgeting app based on a method to give every dollar a job, similar to envelope budgeting. It features detailed budgeting, spending analysis, and goal-setting tools. YNAB syncs with bank accounts and allows real-time budget sharing, which is useful for couples managing joint finances. While it’s not necessarily built for couples, two people can share one account.

YNAB offers manual and automatic transaction importing. I find it helpful to manually add transactions to YNAB as I make them, then I make sure they match the credit card transactions that automatically import. This is helpful when a credit card purchase comes through and you can’t remember what the purchase was for.

YNAB is not as focused on investment tracking or bill payment reminders, so you’ll need to keep track of that on your own. While there’s no free version, there is a 34-day trial.

Cost: $14.99/month or $109/year ($9.08 per month).

Best for: Couples dedicated to mastering budgeting and gaining total control over their spending habits.

Summary of Top Personal Finance Apps for Couples

| App | Price | Best For | Strengths | Limitations |

|---|---|---|---|---|

| Monarch Money | $14.99/month or $99.99/year–Get 50% off first year with promo code ROB50 | Tech-savvy couples wanting collaborative, future-focused finance tools | Customizable dashboards, investment tracking, joint financial planning | No free version, learning curve for beginners |

| Origin | $12.99/month or $99/year | Couples seeking complete financial management | Excellent features for couples, best integration of AI | No free version |

| Rocket Money | Free, $7 – $14/month | Couples wanting solid budgeting, tracking recurring expenses | Free version, excellent mobile app and budgeting features | Cancellation services don’t always work |

| YNAB | $14.99/month or $109/year | Couples serious about budgeting and financial control | Powerful budgeting philosophy, educational resources | Steep learning curve, no investment features |

| Simplifi | $5.99/month (billed annually) | Couples seeking automated, easy-to-use budgeting tools | Real-time syncing, modern UI, customized plans | Limited couple features, basic investment tracking |

| PocketGuard | $12.99/month or $74.99/year | Couples needing daily spending guidance | Safe-to-spend feature, bill tracking | Limited planning tools, no investment support |

Final Thoughts

For couples struggling to stay on the same page financially, there’s an app on this list for you. If you’re committed to making budgeting and financial planning a priority in your relationship, Monarch Money may be worth the cost. If you’re new to budgeting, a free app with basic budgeting features may be the best way to get started.